What is Day Trading? A Complete Guide to Fast-Paced Stock Strategies

📚 Table of Contents

- What is Day Trading?

- How Does Day Trading Work?

- Day Trading vs Investing

- Common Day Trading Strategies

- Tools and Platforms for Day Traders

- Legal Rules and Regulations

- Pros and Cons of Day Trading

- Who Should (and Shouldn’t) Try Day Trading?

- How to Get Started with Day Trading

- Risk Management in Day Trading

- Trading Psychology and Discipline

- Frequently Asked Questions

- Final Thoughts

🟢 What is Day Trading?

Day trading is the practice of buying and selling financial instruments—such as stocks, options, or cryptocurrencies—within the same trading day. The goal is to profit from small price movements using speed, timing, and market volatility.

Unlike long-term investors who hold assets for months or years, day traders close all positions by the end of the trading day, avoiding overnight risks.

👉 Many new traders enter the market with excitement but little strategy. It’s important to understand how day trading works before jumping in with real money.

🧭 How Does It Work?

A typical day trade involves:

- Identifying a trade setup using technical analysis

- Placing a buy or short sell order

- Exiting within minutes or hours

- Using stop-loss and take-profit levels to control risk

Most traders use direct-access brokers with fast execution and charting platforms like TradingView, ThinkorSwim, or Webull.

🔍 Day Trading vs Investing

| Aspect | Day Trading | Long-Term Investing |

|---|---|---|

| Time Horizon | Minutes to hours | Months to years |

| Risk | High | Moderate |

| Skill Required | Very high | Moderate |

| Tax Impact | Short-term capital gains | Lower capital gains |

A deeper discussion comparing technical and fundamental analysis is covered in our technical analysis vs fundamental analysis guide.

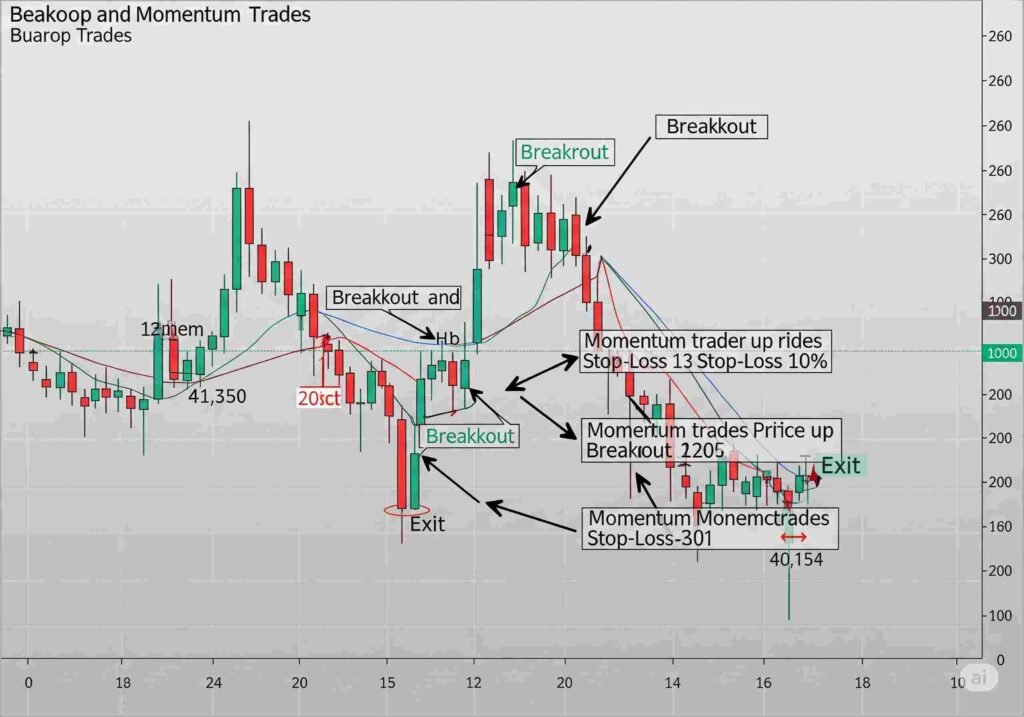

📈 Common Day Trading Strategies

- Scalping – multiple small trades to capture tiny profits

- Momentum trading – ride strong price trends

- Breakout trading – enter trades when price breaks above resistance or below support

- Reversal trading – catching tops and bottoms

You can learn more about indicators and setups in this top stock alerts post, especially if you want to automate your trade alerts.

🛠️ Tools and Platforms for Day Traders

Successful day trading requires:

- Fast broker execution: like Interactive Brokers or Fidelity Active Trader Pro

- Charting software: TradingView, ThinkorSwim

- News feeds: Benzinga or MarketWatch

- Community/Alert systems: We offer real-time signals at TradeStockAlerts

👉 Be sure to review our best trading books list for more tools and mental strategies.

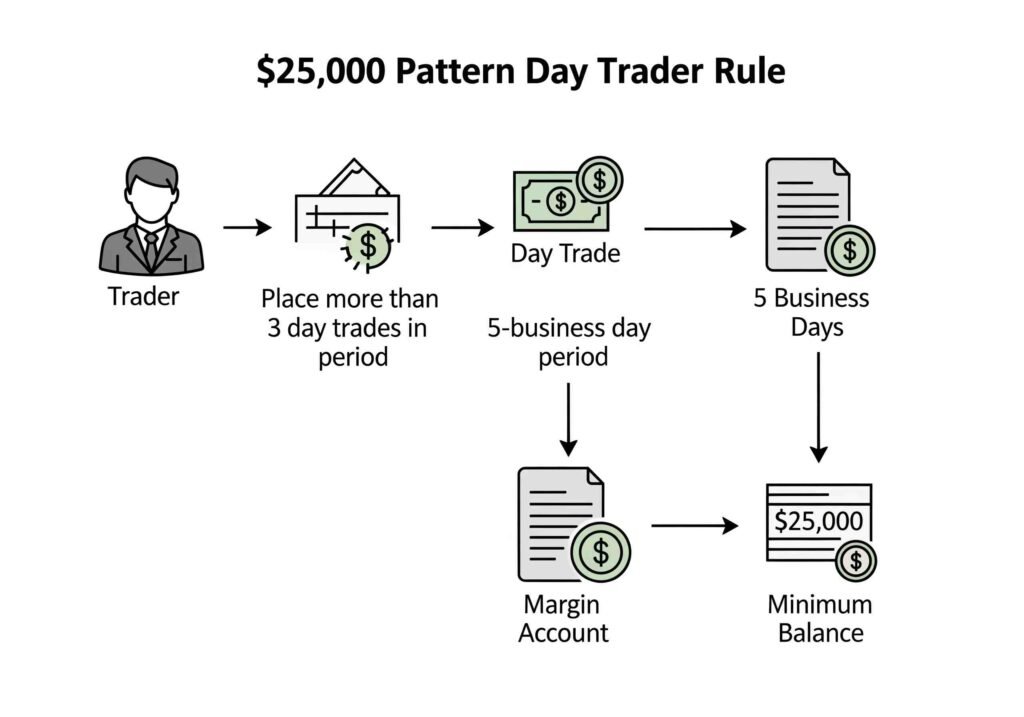

⚖️ Legal Rules and Regulations

ay traders must follow strict rules, especially in the U.S.:

- Pattern Day Trader (PDT) Rule: Requires a minimum of $25,000 in your brokerage account to make 4+ trades in 5 business days.

- Wash-Sale Rule: Prevents claiming tax deductions on certain losses.

Learn more from FINRA and the SEC Day Trading Disclosure.

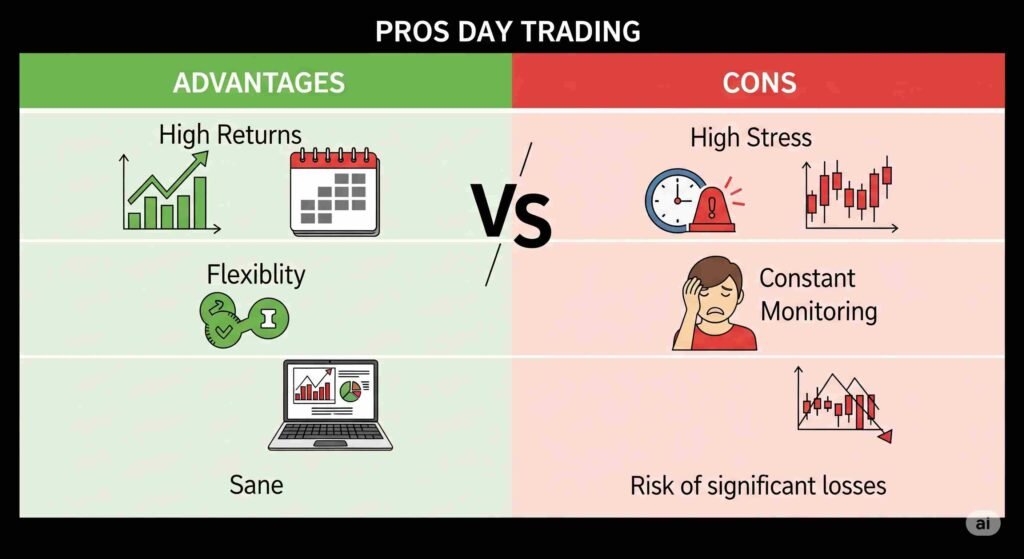

⚠️ Pros and Cons of Day Trading

✅ Pros

- Quick potential profits

- No overnight risk

- Full-time or part-time flexibility

❌ Cons

- High stress and risk of large losses

- Steep learning curve

- Requires constant screen time

Read about the importance of risk management in trading in our post here.

👤 Who Should (and Shouldn’t) Try Day Trading?

Day trading is not for everyone. Ask yourself:

- Can you handle losing days?

- Do you enjoy analyzing patterns and charts?

- Can you commit time daily?

If you’re unsure, start by reading our post on owning stocks vs owning businesses to better understand your investing personality.

🚀 How to Get Started

- Learn the basics (you’re here!)

- Choose a broker with a good trading platform

- Practice in a simulator

- Study trading psychology and risk

- Start with small capital

You’ll also want to understand how much you need to start. Visit our article: how much money do you need to trade stocks

🛑 Risk Management

A trader without risk control is doomed. Every professional uses:

- Stop-loss orders

- Maximum daily loss limits

- Position sizing

For more, visit our full breakdown on trading losses and how to manage them.

🧠 Trading Psychology and Discipline

Success isn’t just technical—it’s mental. You must:

- Control emotions

- Stick to your plan

- Accept losses

Our guide on trading psychology explains how mindset separates winners from losers.

🙋 Frequently Asked Questions

What is the minimum amount to start?

You can start with as little as $500, but U.S. brokers enforce a $25,000 minimum for margin accounts under the PDT Rule.

Is It legal?

Yes, but it’s regulated. Check your country’s financial authority.

Is day trading profitable?

Some succeed, but 90% of day traders fail over time according to Bloomberg research.

What is the best time to trade?

The first hour (9:30-10:30am ET) is usually most volatile and offers the best setups.

What are common mistakes in day trading?

- Overtrading

- Not using stop losses

- Ignoring the news

📣 Final Thoughts

Day trading is thrilling, fast-paced, and potentially profitable—but it’s not a get-rich-quick scheme. It takes time, discipline, and a strong plan backed by education.

Start with small trades, track your results, and consider joining a signal service like TradeStockAlerts for real-time updates and mentorship.

📌 Bookmark this guide, return to it often, and don’t forget to subscribe to our email list for daily trade alerts and exclusive content.