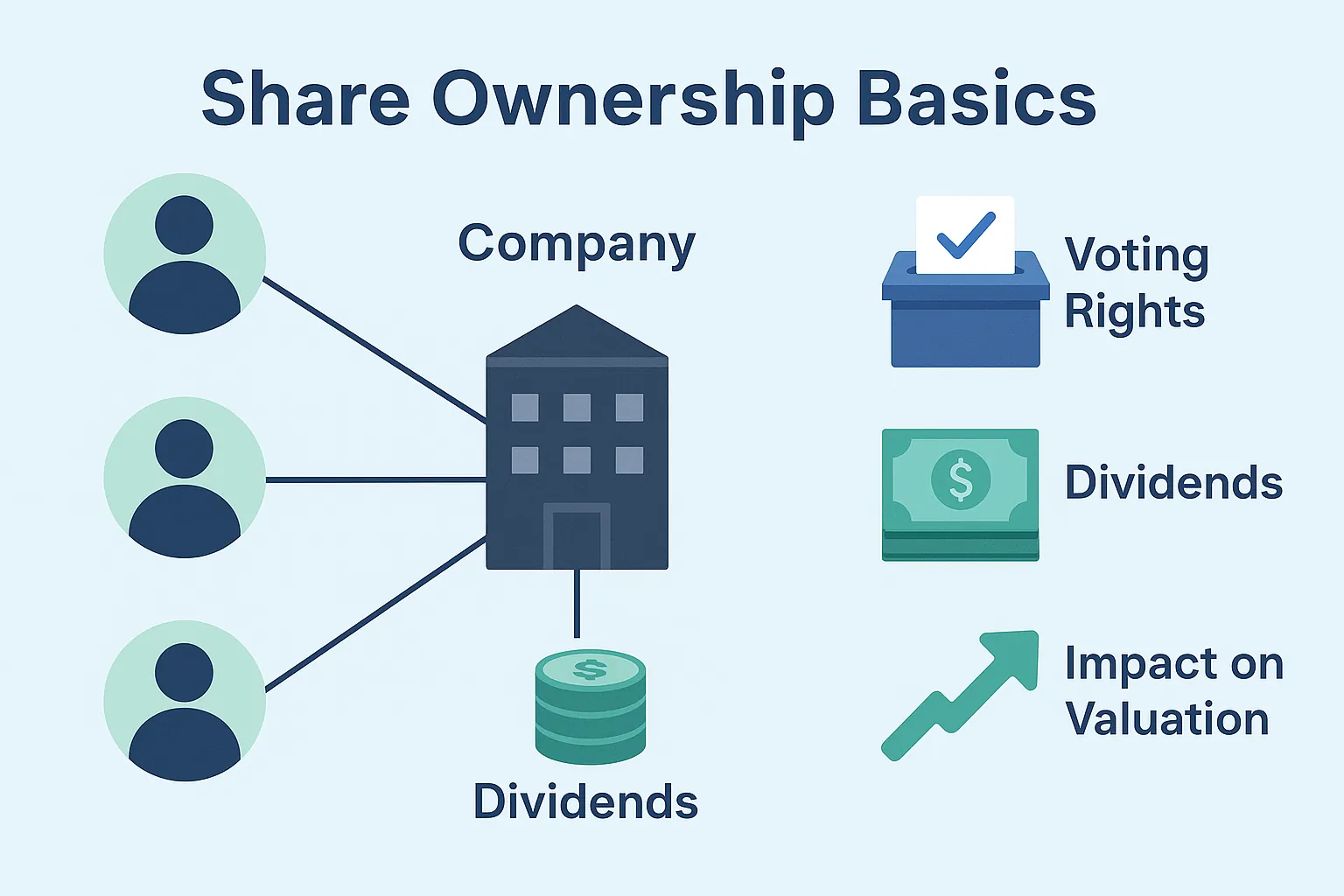

A share of stock is a legal claim on a portion of a company’s earnings and assets. It’s not just a symbol on a screen—it’s ownership. Start with the fundamentals in What Are Stocks?:contentReference[oaicite:0]{index=0}, then build intuition for price and value with Understanding the Real Value of a Stock:contentReference[oaicite:1]{index=1}.

Most beginners encounter common vs. preferred shares, voting rights, and dividends. These choices affect control, income, and risk. For a clear primer on share classes, see Forms of Stocks: Common vs Preferred:contentReference[oaicite:2]{index=2}. Pair that with a disciplined research habit so you don’t mistake ticker noise for insight.

“An investment in knowledge pays the best interest.” — Benjamin Franklin

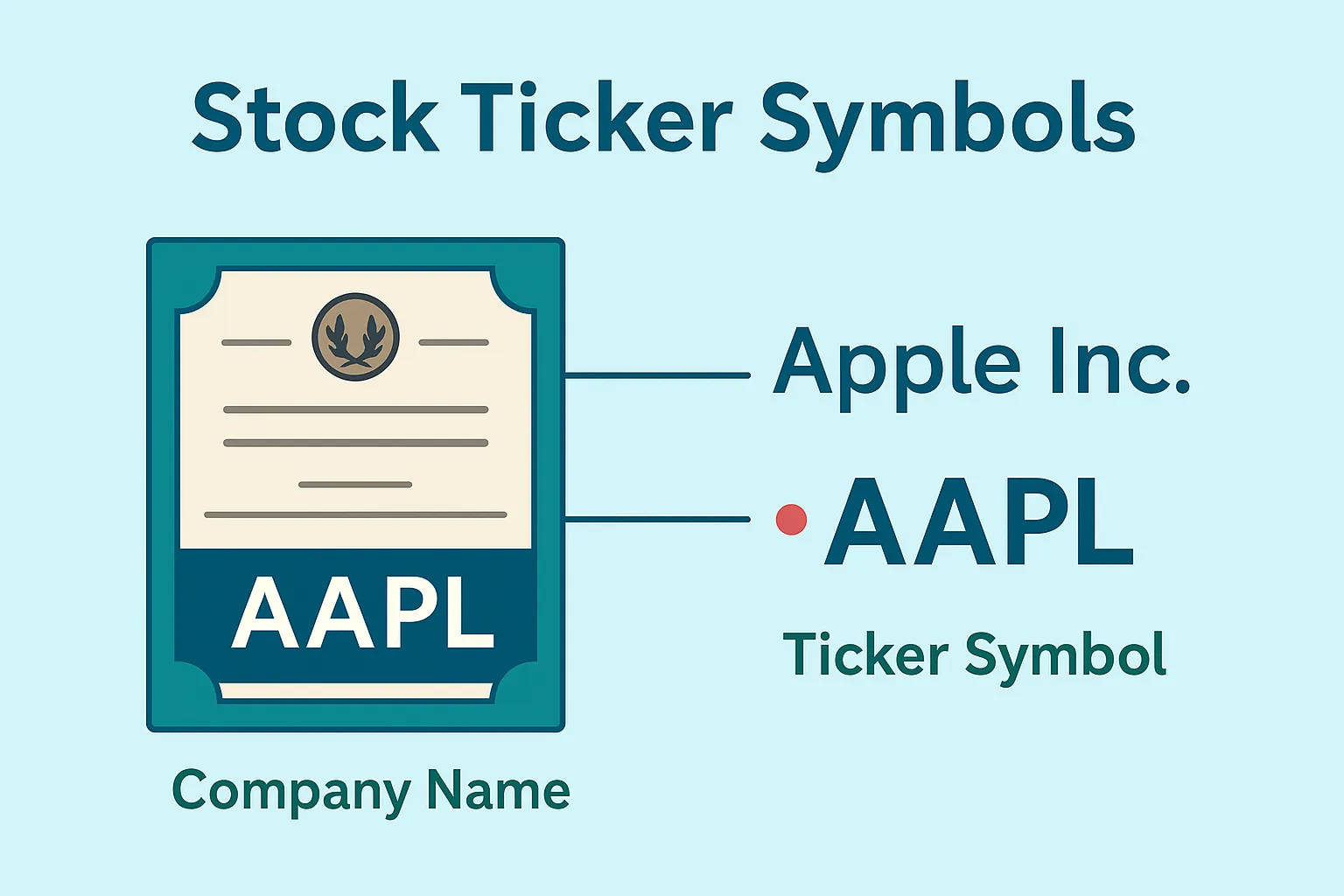

As you progress, connect shares to tickers and market structure. Tickers identify the exact instrument you’re buying; exchanges and indices provide the environment and benchmarks around it. The payoff is practical: better entries, fewer errors, and a portfolio that’s aligned with your goals—not headlines.

- Shares = ownership. Your rights (votes/dividends) flow from that fact.

- Class matters. Common vs. preferred affects control and income.

- Context wins. Read fundamentals and valuation, not just price moves.

Ready to go deeper? Next up: The 5 Powerful Insights That Will Transform Your Knowledge—a crisp roadmap from rights and classes to splits and supply–demand dynamics.