How Difficult is it to Predict the Stock Market?

“The stock market is filled with individuals who know the price of everything, but the value of nothing.” — Philip Fisher

🔍 Summary: Can the Stock Market Truly Be Predicted?

Predicting the stock market is notoriously difficult, even for experts. This blog explores the psychological, technical, and macroeconomic barriers to market forecasting. We also feature expert opinions, real-life case studies, pros and cons, and offer guidance on what can help you navigate this volatile space with confidence.

📑 Table of Contents

- Introduction: The Quest to Predict the Market

- Why Predicting the Market Is So Challenging

- Expert Opinions on Market Prediction

- Case Studies: When Predictions Failed and When They Worked

- Pros and Cons of Trying to Predict the Market

- Key Takeaways

- FAQ: Predicting the Stock Market

- Further Reading & Related Content

📈 Introduction: The Quest to Predict the Market

Trying to predict the stock market has been described as trying to catch lightning in a bottle. For every successful forecast, there are hundreds that miss the mark completely.

Why is it so tempting? Because getting it right can mean immense wealth. Tools like technical analysis, AI-driven algorithms, and economic models attempt to tame the chaos — yet the unpredictability remains.

If you’ve ever explored topics like how a stock’s volume can affect its price or tried identifying bad stock news before it hits, you’ve probably realized just how complex forecasting is.

🚧 Why Predicting the Market Is So Challenging

There are four major obstacles to reliable stock market prediction:

- Human Psychology – Fear and greed create irrational market behavior.

- Random News Events – Black Swan events like COVID-19 crash or sudden wars disrupt trends.

- Algorithmic Trading Volatility – High-frequency trading can exaggerate market movements.

- Data Overload – Too much noise makes it hard to filter for actionable insights.

Markets often move in response to sentiment rather than logic. According to Nobel Laureate Robert Shiller, “Markets are driven more by narratives than numbers.”

For instance, even predictions backed by advanced AI, like those used in Ethereum price forecasts, have failed to consistently beat the market.

🧠 Expert Opinions on Market Prediction

We’ve gathered some key perspectives from professionals:

“The most reliable way to predict the future of the stock market is to not try at all. Focus on risk management, not crystal balls.”

— Dr. John Carter, Author of Mastering the Trade

“Short-term predictions are mostly noise. Long-term trends are driven by earnings, innovation, and economic cycles.”

— Liz Ann Sonders, Chief Investment Strategist, Charles Schwab

“AI has made strides, but even the best models fail during black swan events.”

— Greg Foss, Bitcoin Analyst and Market Forecaster

To balance these insights, you can explore strategies like owning stocks as business ownership instead of trying to time every move.

📚 Case Studies: When Predictions Failed and When They Worked

Stock market history is filled with examples of failed predictions—and a few surprising successes. Here are two telling examples:

❌ The 2008 Housing Crash – A Missed Warning

Despite signs of a real estate bubble, many top economists and institutions failed to anticipate the 2008 global financial meltdown. Predictions from major banks remained bullish right up until the crash. One rare voice, Dr. Michael Burry, correctly predicted the collapse by analyzing subprime mortgage data—proving that accuracy is possible, but rare.

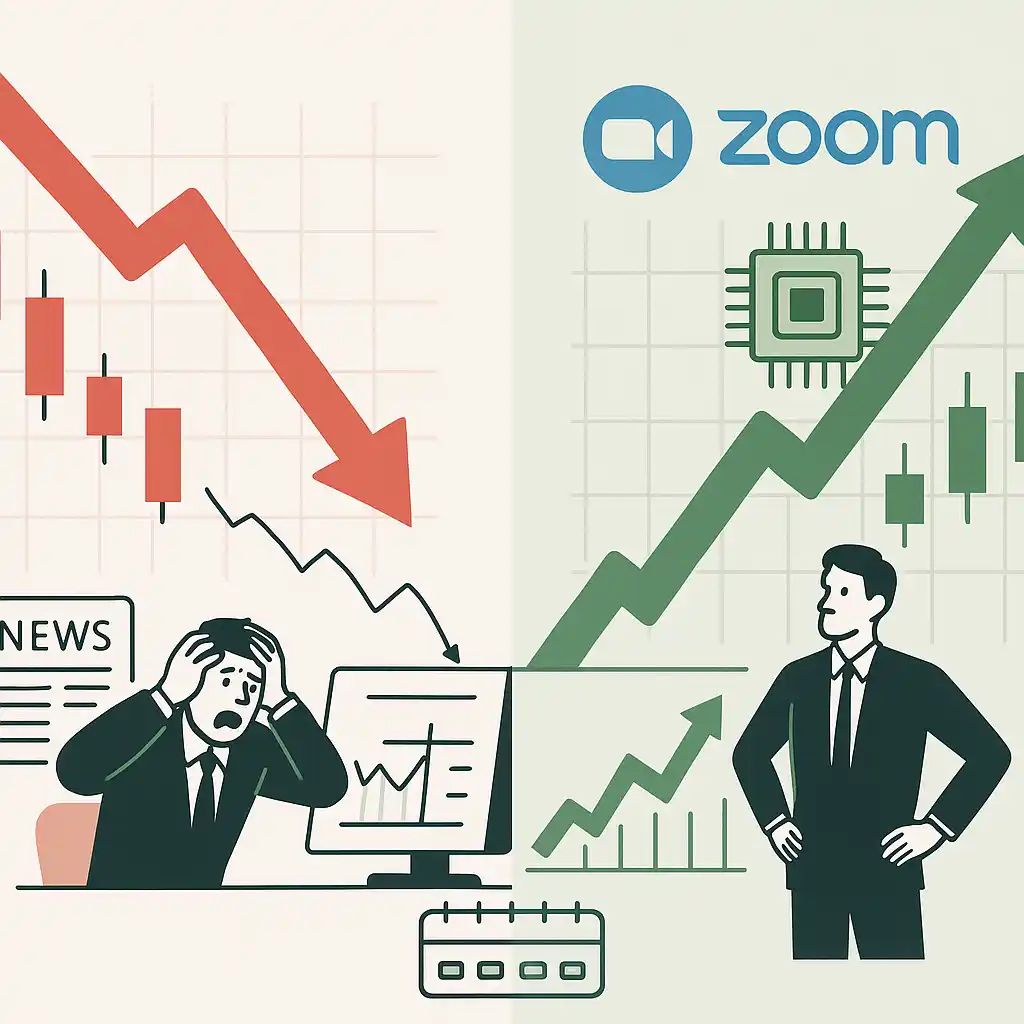

✅ 2020 Tech Surge – A Well-Timed Bet

During the pandemic, some investors saw opportunity in tech stocks. Those who bought into platforms like Zoom or even forecasted a return of semiconductor demand made huge gains. One of our users used swing trading success strategies to ride NVIDIA from $60 to over $300 during this period.

Want to learn how he did it? Check out our guide on daily trading alerts for real-time market moves.

⚖️ Pros and Cons of Trying to Predict the Market

Is it worth trying to predict the market? Let’s break it down:

| ✅ Pros | ❌ Cons |

|---|---|

| ✔ Potential for early profits on trending sectors | ✖ High likelihood of being wrong in short-term |

| ✔ Encourages deep market research | ✖ Confirmation bias can cloud judgment |

| ✔ Builds awareness of global macro trends | ✖ Overconfidence often leads to overtrading |

| ✔ Can help identify long-term investment opportunities | ✖ Market timing rarely outperforms long-term holding |

📌 Key Takeaways

- Prediction ≠ Certainty: Even with data, most short-term forecasts are speculative.

- Long-term investing often outperforms active prediction attempts.

- Tools like alerts and trend tracking (see this strategy PDF) can improve decision-making without relying on predictions.

- AI tools are evolving, but not yet dependable alone—especially in uncertain markets.

- Risk management is more valuable than “guessing right.”

❓ FAQ: Predicting the Stock Market

Q1: Can anyone consistently predict the stock market?

No. Even professionals get it wrong often. The market is influenced by too many unpredictable factors like global events, politics, and investor psychology.

Q2: What tools can help improve market prediction?

Technical indicators, AI models, economic data, and trading alerts can offer insights—but none guarantee success. You can use tools like Swing Trade Bots or swing trading methods to get better context for decision-making.

Q3: Should I avoid predictions altogether?

Not necessarily. Use predictions as hypotheses—not facts—and always apply risk management. Focus more on your entry/exit strategy and portfolio balance than on “being right.”

Q4: Is long-term investing more reliable?

Yes. Historical data shows that long-term investing—especially with diversification—offers a more stable return profile. Learn more in our long-term investment guide.

📚 Further Reading & Related Content

- Full archive: How Difficult Is It to Predict the Stock Market?

- Bitcoin Price Predictions: What to Expect

- Stock Market Investing Fundamentals

- NYT: Why AI Struggles to Predict the Market

- CNBC: Why Forecasting Often Fails

- Investopedia: Why Predicting the Market Is So Hard

- Forbes: Is Stock Market Prediction Possible?

📘 Why Predicting Markets Is So Hard – Investopedia

Investopedia dives into the behavioral finance behind market prediction and why traditional models often fail.

📗 Is Stock Market Prediction Possible? – Forbes

Forbes breaks down the latest advances in AI and their role in attempting to forecast market behavior.

🧠 Why AI Still Can’t Predict the Market – NY Times

Despite advances, AI faces roadblocks in understanding market psychology, according to NYT analysts.

📉 Market Forecasting Fails More Than It Works – CNBC

CNBC covers why even top institutional forecasts often miss, especially during high-volatility periods.

🎓 Why Even Smart Investors Can’t Predict the Market – HBR

HBR examines why the smartest minds still fail at short-term predictions and what that means for your strategy.