From Pocket Notes to Portfolio Gains: A Low-Tech Guide to Smart Investing

CARRY A WATCHLIST

🔍 Quick Summary – Your Old-School Investing Edge

If you’ve ever scribbled down a stock ticker on a napkin or notebook, you’re already halfway to smart investing. This guide explores how low-tech habits like handwritten watchlists, combined with high-impact strategies like dividend compounding and DRIP plans, can build serious long-term wealth. We’ll highlight expert insights, pros and cons, and real case studies to guide your path to profit.

📝 Why Pocket Notes Still Win in a Digital World

“Discipline is remembering what you want.”

– David Campbell

Apps are great. But sometimes, paper is better.

In a world obsessed with digital solutions, it may seem counterintuitive to keep a handwritten list of the stocks you’re watching. But there’s real science and psychology behind it — and it could make you a better investor.

Keeping a physical stock list in your pocket, backpack, or bedside table provides a constant, tactile reminder to stay engaged with the market. It keeps your investment strategy front-of-mind without the distraction of endless app notifications or scrolling feeds.

🧠 Why It Works: The Science of Memory & Focus

According to cognitive researchers, writing something down helps embed it in your memory more effectively than typing. When you jot down a ticker symbol or stock idea, you’re actively processing that information and committing it to long-term memory. That improves focus, action-taking, and recall.

Even Warren Buffett is known for his preference for “paper tracking” methods — old-school, but powerful.

✅ Key Benefits of Paper-Based Stock Tracking:

- ✅ Boosts memory retention and focus on what matters

- ✅ Keeps your stock ideas distraction-free and private

- ✅ Helps form stronger long-term habits through visual reinforcement

- ❌ No real-time updates or alerts

- ❌ Risk of misplacing your list

📌 Why Simplicity Wins in Trading

It’s easy to get overwhelmed by analysis paralysis. With too many tools, alerts, and dashboards, your strategy can become noise. A simple list of 5–10 companies you’re researching — written on paper — helps you stay grounded and focused on quality, not quantity.

This tactic aligns beautifully with proven trade strategies like daily stock picks that prioritize momentum and actionable setups:contentReference[oaicite:0]{index=0}.

Sometimes, going analog is the most efficient digital strategy you’ll ever try.

🧠 The Psychology of Writing It Down: Focus, Memory, and Action

“What gets written, gets remembered. What gets remembered, gets done.”

– Unknown

What’s the difference between thinking about something and writing it down?

According to neuroscience studies, writing by hand engages multiple areas of your brain — including those responsible for memory encoding, emotional focus, and decision-making. It creates a unique neurological “imprint,” helping you remember what you wrote, and nudging you to take action later.

Simply put: writing makes goals real. For investors, this means a written stock list is more than a tracker — it’s a psychological trigger that encourages consistent review and long-term commitment.

🎯 Focus, Habit, and Financial Intention

High performers in business and investing — from Ray Dalio to Richard Branson — have long kept journals or handwritten notes. This “analog” method helps filter out distractions and keep focus tight on goals.

By building a ritual around physically reviewing your watchlist (e.g., every Sunday morning with coffee), you’re creating a habit loop. This loop improves your investing consistency over time, which matters more than timing the perfect entry.

✅ Key Advantages of Handwritten Investment Tracking

- ✅ Helps develop daily and weekly investing habits

- ✅ Strengthens emotional connection to your financial goals

- ✅ Filters out app-based distractions

- ❌ No push notifications or auto-reminders

- ❌ Harder to analyze historical data at scale

📘 Real Use Case: Morning Review Routines

Let’s say you write down your top 3 dividend stocks each week. You place the list by your bedside or inside your wallet. Every morning before your trading day begins, you review it while sipping coffee.

This daily “reset” isn’t just good for discipline — it’s also your way of staying engaged in the market’s tempo. When combined with other strategies like day trading alerts or swing trading signals, it ensures you’re never operating blindly:contentReference[oaicite:0]{index=0}.

Image Placeholder: dividend-stocks-explained.webp (≤50KB)

🔗 Expert Resource Cards

Explains how writing activates cognitive pathways for stronger recall and emotional intent.

Learn how tiny rituals, like a daily list, rewire your brain for better investing behavior.

💸 Dividend Stocks: The Quiet Engine of Wealth

“Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.”

– John D. Rockefeller

Dividend stocks are the quiet workhorses of long-term wealth building. They pay you to wait. And when structured wisely, they can provide consistent income whether the market is up, down, or sideways.

In essence, a dividend is a portion of a company’s profit that gets shared with shareholders — typically every quarter. Some companies also pay monthly or semi-annually. These payouts are your reward for owning shares in businesses that are profitable and financially stable.

💼 Why Dividend Stocks Matter

Unlike growth stocks that rely on price appreciation, dividend-paying stocks offer a steady cash flow. Reinvesting those dividends (which we’ll cover in the next section) lets you harness the power of compounding — turning small payouts into a major wealth engine.

🟢 Pros of Dividend Stocks:

- ✅ Regular income while holding the stock

- ✅ Signals company health and profitability

- ✅ Often outperform during market downturns

🔴 Cons:

- ❌ Lower growth potential than high-flying tech stocks

- ❌ Dividends can be reduced or eliminated

🎙️ Expert Insight

“A sustainable dividend is a sign of corporate strength, not just generosity.”

– Anne Lester, former Head of Retirement Solutions at JPMorgan Asset Management

This means you can use dividends as a kind of financial “health check.” If a company has a consistent dividend history, raises it annually, and has a payout ratio below 60%, it’s usually a solid long-term hold.

📊 Case Study: Pepsi (PEP)

Let’s say you bought $10,000 worth of Pepsi stock in 2000 and reinvested every dividend. As of 2024, your investment would be worth over $88,000 — and you’d be earning thousands annually in dividend income alone.

That’s the power of compounding in action.

🔗 Internal Resource

Want to build a passive income stream like this? Start with this practical guide: Income Generation: Leveraging Dividends:contentReference[oaicite:0]{index=0}

🔗 External Resource Cards

An authoritative breakdown of how dividends work, the types, and how they benefit shareholders.

Beginner-friendly guide to identifying high-quality dividend-paying companies.

🔁 From DRIP to Riches: How Reinvesting Changes the Game

“The magic of compounding works best when you leave your money alone.”

– Jack Bogle, Founder of Vanguard

What if your dividends could buy more shares of stock — without you ever lifting a finger?

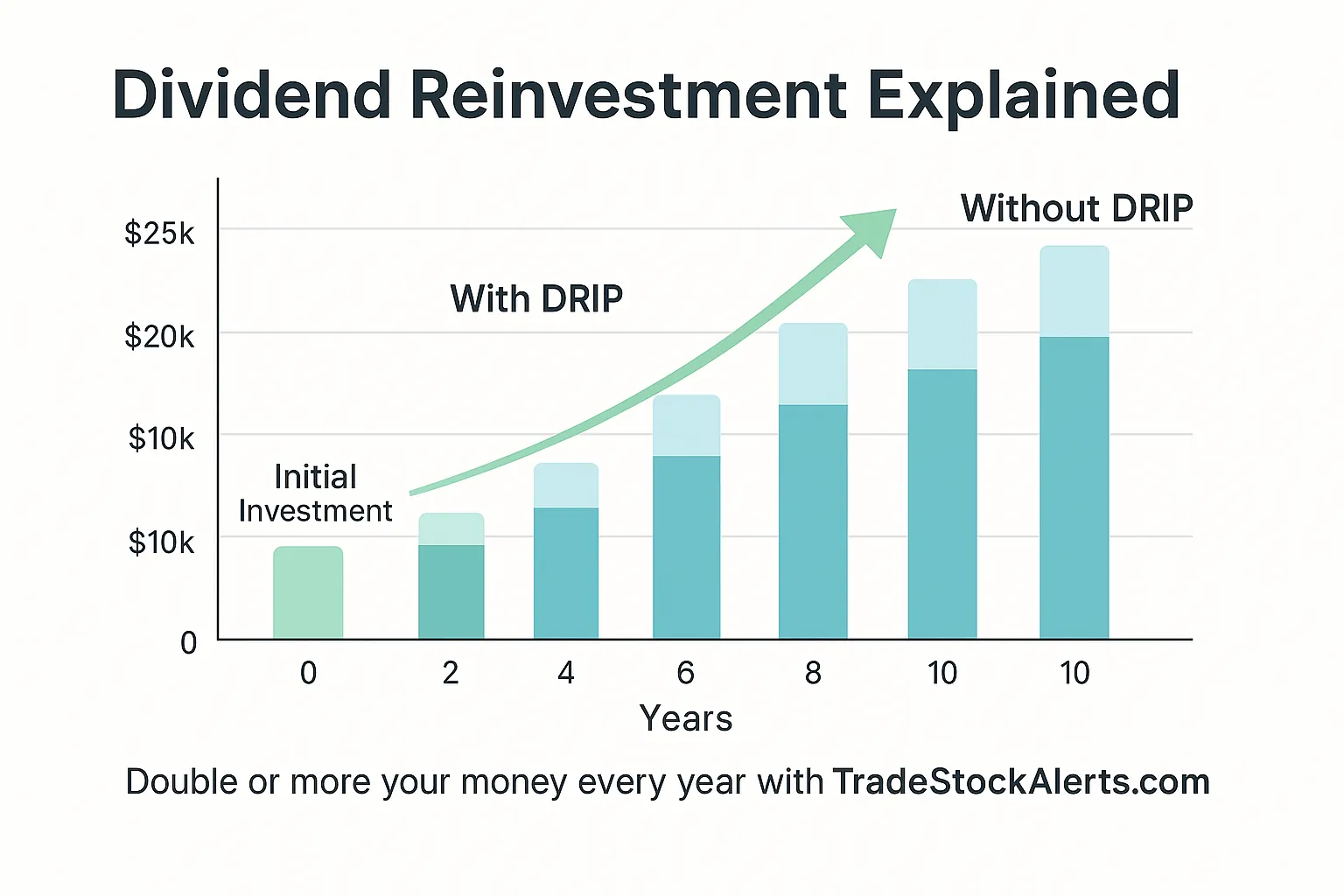

That’s exactly what a Dividend Reinvestment Plan (DRIP) does. Instead of depositing dividend payments into your account as cash, a DRIP automatically uses that money to buy more shares — even fractional ones — of the same stock. Over time, this “loop” builds exponential wealth through the power of compounding.

🌱 DRIP Defined: Dividend Reinvestment Plan

Most major brokers offer DRIP options. Once activated, you don’t need to monitor or manually reinvest anything — your dividends are used automatically to acquire additional shares (or fractions thereof) each payout cycle.

This is where long-term investing shines. Even if stock prices fluctuate, reinvested dividends can stack up quietly in the background and dramatically increase your share count over the years.

🟢 DRIP Advantages:

- ✅ Hands-off wealth-building strategy

- ✅ Amplifies compounding with time

- ✅ No fees or commissions in most cases

🔴 DRIP Disadvantages:

- ❌ Not ideal for short-term traders

- ❌ Reduces cash availability for diversification

Image Placeholder: drip-compounding-strategy.webp (≤50KB)

📈 Simple Example

Suppose you own 100 shares of a stock that pays a $0.50 quarterly dividend. You’d receive $50 every three months. With DRIP turned on, that $50 buys more shares — and those new shares earn their own dividends next time. Repeat for a decade, and you’ll be shocked how much more you own.

🔗 Internal Link

DRIPs pair perfectly with a diversified long-term portfolio. Here’s how to get started with just $1K: Build a Diversified Portfolio from $1,000:contentReference[oaicite:0]{index=0}

📚 External Resource Cards

The U.S. Securities and Exchange Commission explains how DRIPs work and their investor benefits.

Learn the pros, cons, and strategies behind reinvesting dividends for steady growth.

📈 Real-Life Stories: Small Habits, Big Portfolios

“You don’t need a high IQ or inside info. Just discipline, patience, and the right habits.”

– Warren Buffett

We’ve explored theory. Now let’s see what these low-tech habits and dividend strategies look like in the real world. These stories aren’t overnight wins — they’re proof that consistency and simplicity beat complexity and hype.

🧔 John’s $91K Journey

Back in 2010, John was a young schoolteacher who started writing down stocks in a spiral notebook. Every paycheck, he’d allocate $100–$200 to dividend-paying companies like Coca-Cola, McDonald’s, and AT&T.

He turned on DRIP through his broker and never touched the portfolio. He tracked his holdings monthly in that same notebook, using highlighters to mark which stocks raised their dividend.

Fast-forward 12 years: His $7,000 in deposits had grown into a $91,000 portfolio — mostly from DRIP-fueled compounding.

💼 Mary’s Minimalist Method

Mary, a freelance writer, began keeping a stock list in her wallet. She didn’t want apps or screen time. She focused on dividend aristocrats like Procter & Gamble and Johnson & Johnson.

Every month, she invested a small amount manually and reinvested dividends. Her portfolio wasn’t flashy, but by 2023, it was paying her enough in quarterly dividends to cover her rent.

Her only tech? A basic calculator, a paper tracker, and her consistent habit of reviewing her holdings every Saturday morning.

📊 Pros & Cons of These Low-Tech Approaches

🟩 What Worked:

- ✅ Built wealth through consistent small contributions

- ✅ Avoided the emotional traps of daily market watching

- ✅ Used DRIP to quietly grow positions without stress

🟥 What Didn’t:

- ❌ No real-time alerts meant missed short-term plays

- ❌ Less opportunity for high-growth stock gains

📌 Internal Link for Proof

If you think $100 doesn’t go far, read this: How $100 Became $1,000 – 3 Real Stock Stories That Prove It’s Possible:contentReference[oaicite:0]{index=0}

💬 Expert Commentary

“The investors who do best over time aren’t chasing headlines. They’re quietly building, compounding, and reinvesting.”

– Morgan Housel, Author of ‘The Psychology of Money’

💡 Key Takeaway

🎯 Expert Takeaways + Your Next 3 Action Steps

“Successful investing is about behavior, not brilliance.”

– Carl Richards, Financial Author & CFP

You’ve now seen how consistent, low-tech investing habits like using a paper watchlist and enrolling in DRIPs can build serious wealth. Now it’s time to take action.

✅ Your Next 3 Action Steps

- Write down 3 dividend-paying stocks you’re interested in — include their current price and yield.

- Set up DRIP (Dividend Reinvestment Plan) through your brokerage. Most platforms offer this under account settings.

- Track your dividend income quarterly in a simple notebook, spreadsheet, or checklist.

Image Placeholder: smart-investing-checklist.webp (≤50KB)

🔗 Internal Link

Want to combine DRIPs with high-momentum trading setups? See this: Swing Trading Techniques That Actually Work:contentReference[oaicite:0]{index=0}

🔗 Expert-Approved External Resources

Use this official tool to see how DRIP and reinvesting can grow your account over time.

See current high-performing dividend stocks ranked by yield and history.

📘 Final Expert Highlight

“Most millionaires didn’t get there through luck — they automated good decisions and stuck with them.”

– Ramit Sethi, Financial Educator & Author

❓ Frequently Asked Questions (FAQ)

“An hour of research can save you years of mistakes.”

– Charlie Munger

💬 Q1: What is the main benefit of using a DRIP?

A: The biggest benefit is automatic compounding. DRIPs reinvest your dividends into more shares, helping you accumulate wealth without manual effort or emotional decision-making.

💬 Q2: Are dividends taxed?

A: Yes. In the U.S., most qualified dividends are taxed at the long-term capital gains rate, which is typically lower than ordinary income tax. However, the exact rate depends on your income bracket.

💬 Q3: Can I turn off DRIP later if I want to take cash instead?

A: Absolutely. Most brokers allow you to toggle DRIP settings off and on anytime. This gives you full control over when to take cash and when to reinvest.

💬 Q4: What happens if a company cuts its dividend?

A: If a dividend is reduced or eliminated, the stock price often drops. That’s why it’s important to monitor company fundamentals and news before blindly reinvesting:contentReference[oaicite:0]{index=0}.

💬 Q5: Can a beginner investor use a handwritten watchlist effectively?

A: Definitely. It’s actually encouraged. Writing things down boosts memory, helps maintain focus, and forms better decision-making habits — especially for newer investors.

💬 Q6: What’s the best way to find quality dividend-paying stocks?

A: Look for:

- ✅ Consistent dividend history (5+ years)

- ✅ Dividend payout ratio below 60%

- ✅ Low to moderate debt levels

- ✅ Stable earnings growth

🔗 External Resources (Card Format)

Discover the best dividend-paying companies based on yield, growth, and payout history.

Explore how different industries handle dividends and which ones to watch in 2025.

📌 Internal Resources to Explore Next

- 📘 Owning Stocks Means Owning Businesses:contentReference[oaicite:1]{index=1}

- 📕 What Is Shorting in Day Trading?:contentReference[oaicite:2]{index=2}

- 📊 Penny Stock Alerts That Work:contentReference[oaicite:3]{index=3}

🔗 More Trusted Resources to Improve Your Investing Strategy

Clear and complete breakdown of how Dividend Reinvestment Plans work, and why they’re used by long-term investors.

Learn how dividends work and how they can contribute to a smart investment strategy from a trusted brokerage.

Explore dividend picks, yield rankings, and research from one of the most respected financial research platforms.

🚀 Ready to Grow Your Portfolio with Confidence?

Start today by writing down your watchlist, choosing your dividend stocks, and activating DRIP. With just a few consistent steps, you’ll set the stage for long-term financial growth.

👉 Explore Our Daily Stock Picks Here:contentReference[oaicite:2]{index=2}