Roth IRA or Regular Brokerage Account: Which is Right for You?

💼 Understanding the Basics of Roth IRA and Brokerage Accounts

💡 Summary:

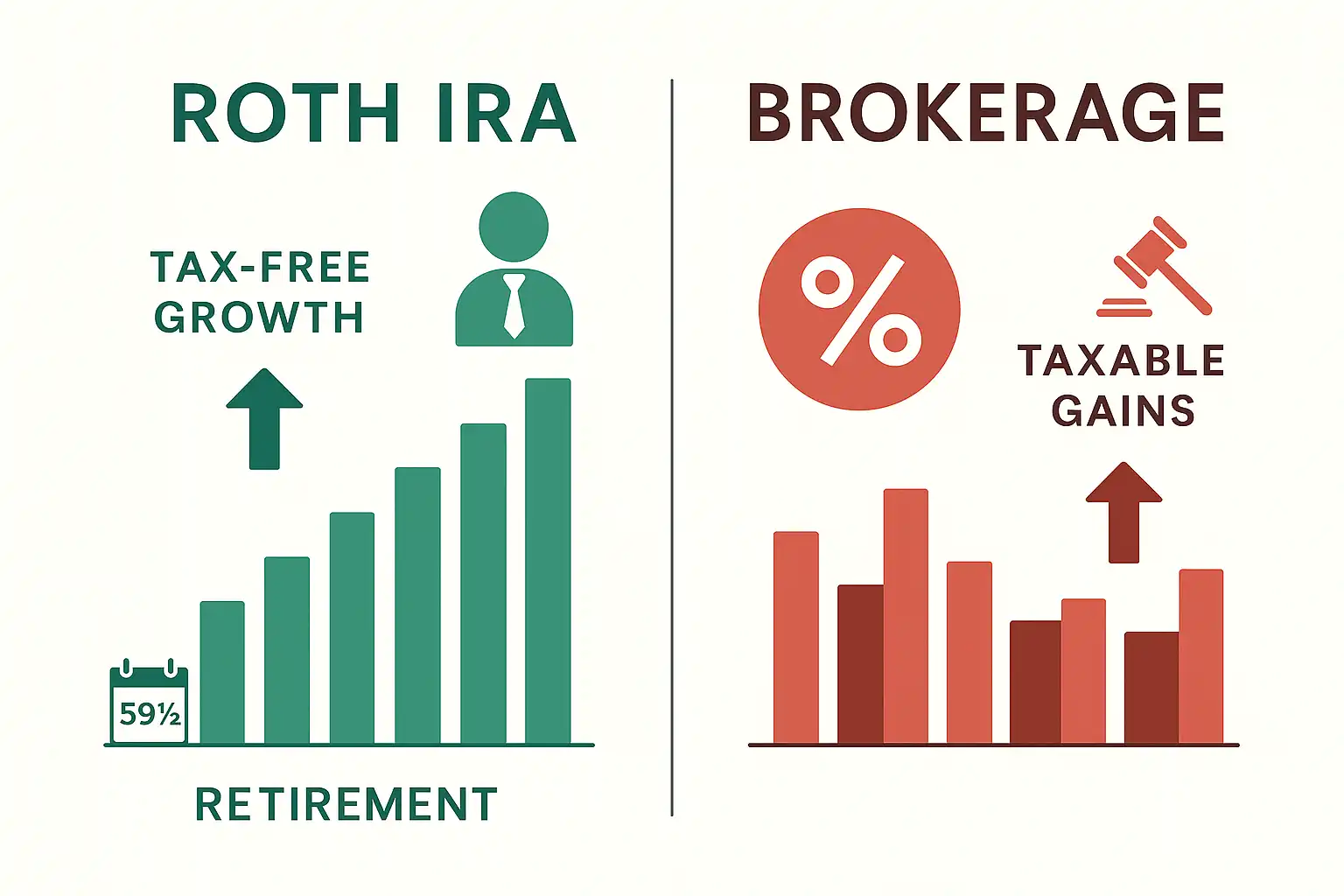

A Roth IRA (Individual Retirement Account) is a tax-advantaged retirement account that allows your investments to grow tax-free. You contribute after-tax dollars, and in return, you get to withdraw your money tax-free in retirement, assuming you meet IRS rules.

In contrast, a regular brokerage account offers no tax breaks upfront or at withdrawal. However, it provides unmatched flexibility—you can invest and withdraw anytime, in any amount, without penalties or contribution limits.

“An investor without a goal is like a traveler without a map.”

– Benjamin Graham

📌 Key Differences at a Glance:

- Roth IRA: Tax-free growth, but limited contributions and withdrawal restrictions

- Brokerage Account: Fully taxable, but unrestricted access and broader investment choices

Want a quick refresher on what you’re actually buying? Check out What Are Stocks? to better understand your portfolio foundation. :contentReference[oaicite:0]{index=0}

And for the official breakdown on Roth IRA eligibility and rules, visit the IRS Roth IRA overview.

💰 Tax Advantages: Short-Term vs. Long-Term Gains

💡 Summary:

Taxation can make or break your investment strategy. A Roth IRA allows you to contribute post-tax dollars, grow your money tax-free, and make qualified withdrawals without paying a cent in capital gains taxes.

On the other hand, a regular brokerage account taxes your profits. You’ll pay:

- Short-term capital gains tax (as high as your income tax bracket) for assets held less than 1 year

- Long-term capital gains tax (typically 0%–20%) for investments held over a year

“The difference between paying taxes and avoiding them legally is often just knowing where to look.”

– Suze Orman

✅ Pros and ❌ Cons: Roth IRA vs. Brokerage (Tax Focus)

- ✔ Tax-free withdrawals from Roth IRA after retirement age

- ✔ No taxes on dividends or interest earned inside a Roth

- ✘ Roth IRA has income and contribution limits

- ✘ You get no tax deduction when you contribute

If you focus on passive income, compare how dividends are taxed in each account—a key detail for long-term investors:contentReference[oaicite:0]{index=0}.

For a more beginner-friendly breakdown, explore NerdWallet’s Roth vs. Brokerage comparison.

🔓 Withdrawal Rules and Early Access Limitations

💡 Summary:

The Roth IRA has specific withdrawal rules that every investor should know. You can withdraw your contributions at any time without penalty, but to access your earnings tax-free, two conditions must be met:

- You must be age 59½ or older

- The Roth IRA must be open for at least 5 years

Early withdrawals on investment earnings may lead to a 10% IRS penalty and income tax charges. There are some exceptions, such as first-time home purchases and qualified education expenses, but planning is key.

Regular brokerage accounts, however, offer complete liquidity. You can sell your assets and withdraw funds at any time with no penalties—though you’ll likely owe taxes on gains or dividends.

“Liquidity can be a blessing or a curse—know your timeline before you touch your investments.”

– JL Collins, author of The Simple Path to Wealth

✅ Pros and ❌ Cons of Access Rules

- ✔ Roth contributions are always accessible

- ✔ No mandatory withdrawals during your lifetime

- ✘ Penalties for early access to earnings

- ✘ Rules can be confusing without planning

Want a beginner-friendly breakdown of all stock market basics? Download our Stock Market for Dummies PDF guide to build foundational knowledge. :contentReference[oaicite:0]{index=0}

For official IRS rules and calculators, visit the Fidelity Roth IRA Withdrawal Rules.

📊 Investment Flexibility: What Can You Trade?

💡 Summary:

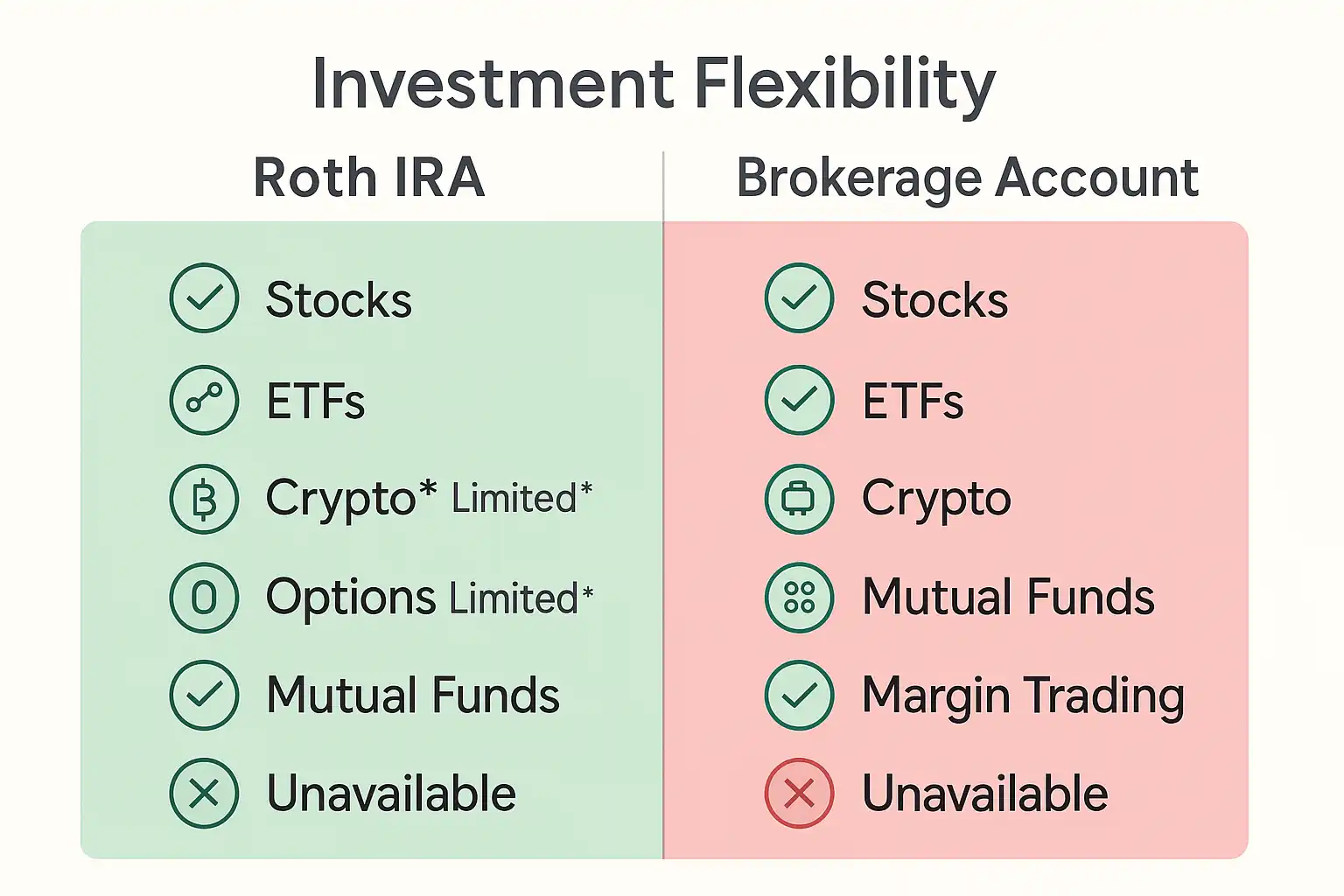

While both account types give you access to core investments like stocks, ETFs, and mutual funds, there are key differences in their flexibility—especially if you plan to trade more advanced instruments.

🔍 Here’s a quick comparison:

| Asset Type | Roth IRA | Brokerage Account |

|---|---|---|

| Stocks & ETFs | ✅ | ✅ |

| Mutual Funds | ✅ | ✅ |

| Options Trading | ⚠️ Limited | ✅ Full Access |

| Cryptocurrency | ❌ Rarely | ✅ (via brokers like Coinbase or Robinhood) |

| Margin Accounts | ❌ Not allowed | ✅ (if enabled) |

“Always match your strategy to your account type. Your goals should drive your platform—not the other way around.”

– Maria Flores, CFA | Vanguard Strategist

✅ Pros and ❌ Cons of Investment Options

- ✔ Roth IRAs are ideal for buy-and-hold investing

- ✘ Limited access to complex strategies like covered calls or short selling

- ✔ Brokerage accounts offer full trading freedom

- ✘ More taxable events and fewer long-term tax advantages

For traders considering options strategies, read our guide on Bull and Bear Spreads for Options to better understand risk exposure:contentReference[oaicite:0]{index=0}.

For more info on retirement-friendly investment vehicles, see Morningstar’s Risk Grading Guide.

⚖️ Risk Management and Strategy Alignment

💡 Summary:

Every investor has a risk tolerance. The key is choosing an account type that matches your goals—and protects you from your own worst impulses.

Roth IRAs are designed for long-term investing. They discourage short-term speculation by limiting high-risk features like margin trading or rapid-fire options strategies. This makes them ideal for retirement-focused investors who want steady compounding without distractions.

On the other hand, brokerage accounts allow full exposure to risky strategies: short selling, margin leverage, day trading, and options spreads. These can yield high returns—but also come with higher tax bills and emotional volatility.

“Risk is what’s left over when you think you’ve thought of everything.”

– Carl Richards, CFP®

✅ Pros and ❌ Cons of Risk Profiles by Account

- ✔ Roth IRA encourages long-term, tax-efficient wealth building

- ✘ Not suitable for high-frequency or speculative traders

- ✔ Brokerage account supports any trading style—from conservative to aggressive

- ✘ Easy to overtrade and rack up taxable events

Real Example: Consider Jack, a 29-year-old investor who used leverage in his brokerage account to short a tech stock. The trade went against him and triggered a margin call—forcing a $6,000 loss in 48 hours. This wouldn’t be possible inside a Roth IRA, which restricts such high-risk exposure.

For more clarity on identifying quality stocks to reduce portfolio risk, check out our breakdown on Understanding the Real Value of a Stock:contentReference[oaicite:0]{index=0}.

And for professional analysis, see Morningstar’s comprehensive risk framework.

👥 Real-Life Case Studies: Roth IRA vs. Brokerage Journeys

💡 Summary:

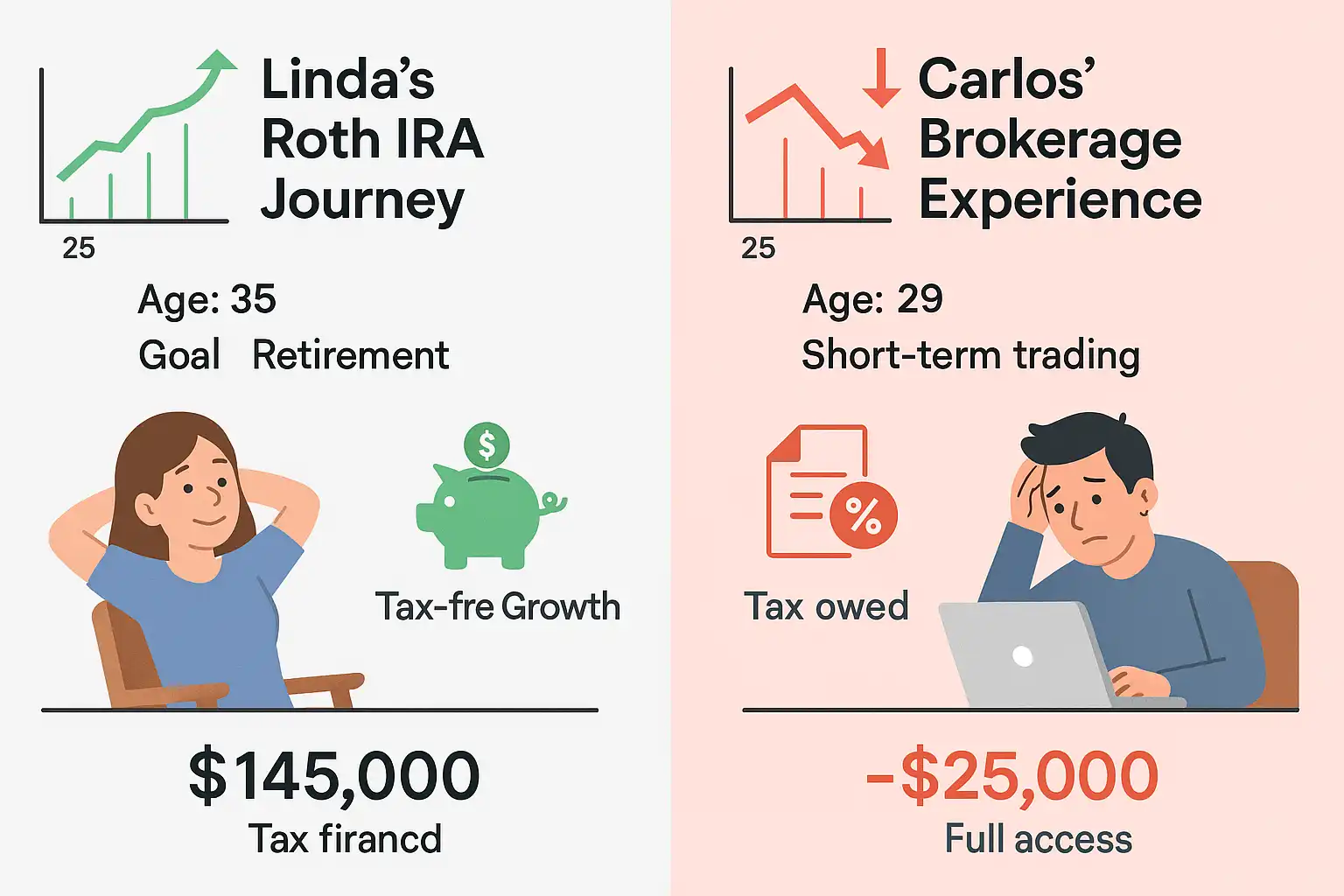

📈 Linda’s Roth IRA Journey

Age: 35

Goal: Retirement security

Strategy: Max out Roth contributions yearly

Linda started investing in a Roth IRA at age 25, steadily contributing $6,000 a year into index funds and dividend stocks. With her account compounding tax-free, she now has over $145,000 saved—and won’t owe taxes on it if she waits until 59½.

Because Roth IRAs don’t require minimum distributions, Linda plans to let hers grow as long as possible, using it later for tax-free withdrawals in retirement.

📉 Carlos’ Brokerage Experience

Age: 29

Goal: Short-term gains

Strategy: Tech stock swing trades

Carlos used his taxable brokerage account to swing-trade high-growth tech stocks. While he made solid returns—earning $25,000 in one year—he paid nearly $8,000 in short-term capital gains taxes due to his holding periods being less than 12 months.

Though profitable, Carlos now diversifies between his brokerage and a new Roth IRA to reduce his tax liability and build a more balanced plan.

“Think long-term. Start early. Sleep well.”

– WealthBuilder Daily

✅ Lessons from Both Paths

- ✔ Roth IRA investors benefit from tax-free growth and peace of mind

- ✘ Brokerage investors face unpredictable tax bills if unplanned

- ✔ Using both accounts can create strategic balance

- ✘ Lack of planning = avoidable losses

Want a smarter portfolio foundation? Read our post on How to Invest Smartly for Long-Term Growth:contentReference[oaicite:0]{index=0}.

🏁 Final Verdict: Which Account is Better for You?

💡 Summary:

There’s no universal answer—only the account that matches your needs, income, and investing timeline. Below is a side-by-side summary to help you evaluate both options based on the most important criteria.

📊 Roth IRA vs. Brokerage Account Comparison Table

| Feature | Roth IRA | Brokerage Account |

|---|---|---|

| Tax Benefits | ✅ Tax-free growth & withdrawals | ❌ Taxed on gains & dividends |

| Liquidity | ⚠️ Contributions only (penalty-free) | ✅ Full access anytime |

| Investment Range | ⚠️ Limited (no margin, crypto) | ✅ Full flexibility |

| Best For | 📈 Long-term retirement growth | 💡 Active traders & short-term goals |

“It’s not either/or. Smart investors often use both accounts to balance flexibility with long-term efficiency.”

– Natalie Wexler, CFP®

✅ Pros and ❌ Cons Recap

- ✔ Roth IRA = tax-free retirement wealth

- ✘ Contribution and income limits apply

- ✔ Brokerage = full liquidity and access

- ✘ No tax sheltering from capital gains

If you’re leaning toward using both (smart move!), we recommend checking our full guide on Roth IRA vs. Brokerage Strategy Integration:contentReference[oaicite:0]{index=0}.

For a broader overview of how each fits into your financial plan, here’s a quick-read from Investopedia’s Roth vs. Taxable Account breakdown.

❓ Frequently Asked Questions (FAQ)

📌 Can I have both a Roth IRA and a regular brokerage account?

Yes! In fact, many investors use both. A Roth IRA is great for long-term, tax-free retirement growth, while a brokerage account offers full liquidity and no contribution limits. Using both allows for strategic flexibility.

📌 Can I day trade inside a Roth IRA?

You can trade actively in a Roth IRA, but many brokers restrict margin trading and pattern day trading due to IRS limitations. Also, since losses in a Roth IRA can’t be written off, high-frequency strategies can be risky.

📌 Are Roth IRA contributions tax-deductible?

No. Contributions to a Roth IRA are made with after-tax dollars, which is why the growth and withdrawals are tax-free. If you’re seeking a tax deduction, a traditional IRA may be more suitable.

📌 What happens if I withdraw Roth IRA funds early?

You can always withdraw your contributions (not earnings) without penalties. If you withdraw earnings before age 59½ and before meeting the 5-year rule, you may face a 10% penalty and income tax.

📌 Is a brokerage account better for short-term goals?

Yes. Brokerage accounts are ideal for short- to medium-term investing goals like saving for a house, car, or vacation—since you can withdraw at any time and invest in anything from stocks to crypto.

🌐 Trusted External Resources

Explore these expert sources to deepen your understanding of Roth IRAs, brokerage accounts, and smart investment planning.

🧾 IRS Roth IRA Rules

The official guide to Roth IRA eligibility, tax benefits, and withdrawal rules.

View IRS Website →📊 NerdWallet Roth vs. Brokerage

A beginner-friendly comparison between Roth IRAs and taxable brokerage accounts.

Read Article →📘 Investopedia Deep Dive

A full comparison table and expert editorial on which account suits your strategy best.

Compare Here →🏦 Fidelity Roth Withdrawal Guide

Interactive tools and withdrawal rule scenarios from one of the largest brokerages.

Explore Fidelity Guide →