7 Historic Trading Choices You Should Never Repeat

When Not to Exercise A Choice Historical

🌷 The Tulip Bubble and FOMO Trading

💡 Summary:

The 1630s Dutch Tulip Mania is often cited as the first recorded market bubble. At its peak, some tulip bulbs sold for more than a house—until the entire market collapsed. This historical event illustrates one of the most dangerous trading choices ever made: following the crowd without questioning value.

Understanding the real value of a stock is critical, especially in today’s meme-stock and crypto-driven world:contentReference[oaicite:0]{index=0}.

“The Tulip Bubble taught us that speculative hype can drive prices far beyond value—until it doesn’t.”

– Dr. Andrew Lo, MIT Finance Professor

The behavior behind Tulip Mania is identical to FOMO trading today. Modern platforms like Reddit and TikTok have replaced town squares, but the psychology hasn’t changed.

✅ Pros and ❌ Cons of FOMO Trading

- ✔ Quick gains during hype-driven rallies

- ✘ No exit strategy when momentum fades

- ✘ Emotion-led entries result in irrational risks

📦 Key Takeaway

FOMO kills portfolios. If you’re chasing a stock because everyone else is buying it, you’re likely too late. Learn to assess value independently using fundamentals and chart analysis.

“If you don’t know who you are, the stock market is an expensive place to find out.”

– George Goodman

For a deeper understanding of this concept, consider reviewing Harvard Business Review’s research on investor psychology.

📉 Overleveraging in the 1929 Crash

💡 Summary:

Before the 1929 crash, many investors bought stocks using borrowed money. When prices dropped, brokers issued margin calls—forcing panicked selling and accelerating the collapse. This is one of the clearest historical examples of how overconfidence in leverage can ruin entire portfolios overnight.

Modern traders make the same mistake. Margin accounts offer the illusion of power, but without strict risk control, they’re financial landmines. For instance, understanding how a stock’s volume affects its price is essential when managing leveraged trades:contentReference[oaicite:0]{index=0}.

“Excess leverage magnifies both gains and losses—usually in that order.”

– Karen Firestone, Aureus Asset Management

✅ Pros and ❌ Cons of Leverage

- ✔ Amplified profits in uptrending markets

- ✘ Margin calls during dips

- ✘ Exponential risk if market turns quickly

📦 Key Takeaway

Never borrow more than you can afford to lose. If you must use leverage, set strict stop-losses and calculate risk-to-reward ratios religiously.

“It’s not whether you’re right or wrong, but how much you make when you’re right and how much you lose when you’re wrong.”

– George Soros

To understand how margin rules have changed, review the SEC’s 1934 report on post-crash reforms.

💻 Dot-Com Delusion: Ignoring Fundamentals

💡 Summary:

The Dot-Com Bubble of the late 1990s was a time when investors poured money into any company with a “.com” in its name—regardless of earnings, revenue, or a working business model. Sound familiar? That same pattern of irrational belief in unproven innovation is echoed today in many SPACs, meme stocks, and crypto projects.

One of the most infamous examples was Pets.com, a company that spent heavily on marketing but had no sustainable margins or logistics infrastructure. It went public in 2000 and collapsed within a year.

“Valuation without earnings is storytelling.”

– Michael Batnick, Ritholtz Wealth

Today’s traders should learn to distinguish hype from healthy fundamentals. That means studying cash flow, debt-to-equity ratios, and taking courses that emphasize core financial analysis skills:contentReference[oaicite:0]{index=0}.

✅ Pros and ❌ Cons of Hype-Driven Trades

- ✔ Early gains if you time it perfectly

- ✘ Fundamentals eventually catch up

- ✘ Overvaluation leads to steep collapses

📦 Key Takeaway

Not all innovation is profitable. Always back your investments with facts—not fads. When in doubt, dig into the company’s 10-K report and analyst coverage.

“In investing, what is comfortable is rarely profitable.”

– Robert Arnott

For a broader look at how market bubbles form, read MIT’s research on behavioral finance and investor biases.

🏠 Subprime Crisis: Trusting the Herd

💡 Summary:

In the early 2000s, financial institutions bundled risky mortgages into complex securities that were misrepresented as safe investments. When the housing market slowed, defaults skyrocketed—causing massive losses for everyone who followed the herd into subprime exposure.

This era taught us one critical truth: Just because “everyone” is doing it, doesn’t make it safe. Even Wall Street professionals got burned. Many retail investors who were encouraged to buy into real-estate ETFs in 2006–2007 saw their positions drop by over 80%.

“If everyone is thinking alike, then somebody isn’t thinking.”

– General George S. Patton (quoted during crisis retrospectives)

Always question the consensus and ask what others are missing. That includes understanding why some brokers may not allow hedging in volatile conditions:contentReference[oaicite:0]{index=0}—a lesson that hit hard during this meltdown.

✅ Pros and ❌ Cons of Following the Herd

- ✔ Can catch strong trends during bull runs

- ✘ Herd behavior amplifies bubbles and panic

- ✘ False security from consensus thinking

📦 Key Takeaway

Consensus ≠ safety. If everyone is rushing into an idea, stop and do the opposite: slow down, investigate, and ask questions.

“The crowd is often wrong at extremes.”

– Howard Marks

For a data-backed breakdown of how this crisis unfolded, see the CNBC interview with Warren Buffett on panic behavior.

😱 COVID-19 Panic Selling and Missed Rebounds

💡 Summary:

In March 2020, the S&P 500 dropped more than 30% in a matter of weeks as the world responded to the spread of COVID-19. Fearing a global depression, millions of retail traders and long-term investors exited their positions in panic—only to watch the market rebound dramatically within months.

What caused this? Fear. Uncertainty. Emotion over logic. This is one of the clearest examples of why traders need an actual game plan—not just a brokerage account. As many learned the hard way, panic selling locks in losses, while the market rewards patience.

“The market is a pendulum. Extreme fear is as dangerous as extreme greed.”

– Barry Ritholtz

Investors with diversified portfolios—especially those focused on fundamentals—recovered and profited. Learn more about how to build a diversified stock portfolio for just $1,000 so you can weather future downturns without panic:contentReference[oaicite:0]{index=0}.

✅ Pros and ❌ Cons of Panic Selling

- ✔ Emotional relief from perceived danger

- ✘ Locks in losses during temporary volatility

- ✘ Misses rapid rebounds fueled by stimulus and recovery

📦 Key Takeaway

Volatility ≠ collapse. Don’t sell in fear without revisiting your long-term investment thesis. History shows that markets rebound faster than most anticipate—if you’re not in, you miss the upswing.

“History doesn’t repeat itself, but it often rhymes.”

– Mark Twain

For an insightful perspective from one of the world’s most trusted investors, watch Warren Buffett’s CNBC appearance on post-COVID investing behavior.

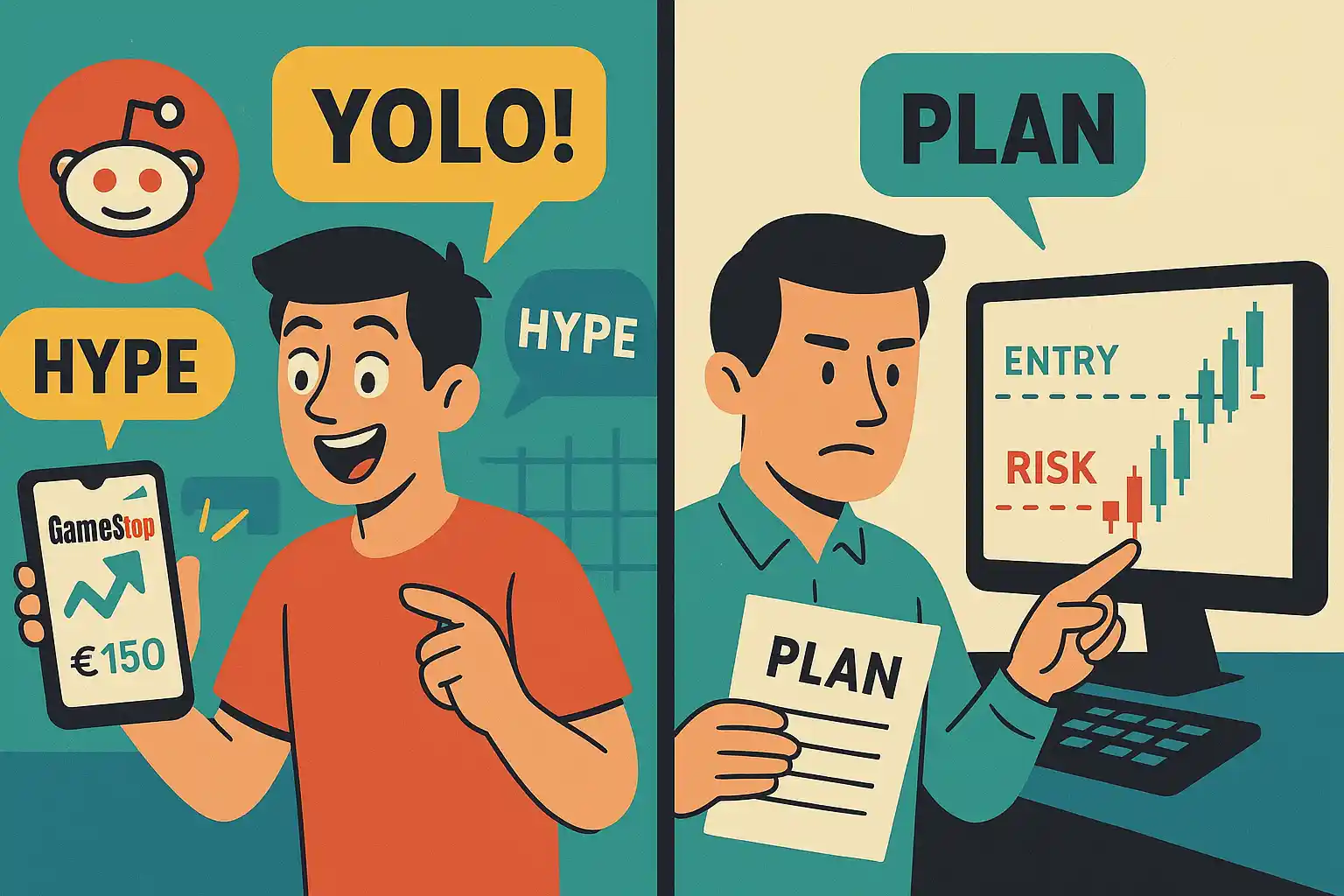

📈 GameStop Frenzy: Emotional Trading

💡 Summary:

In early 2021, GameStop (GME) stock skyrocketed from under $20 to over $400 in just days, driven by Reddit’s r/WallStreetBets and fueled by short squeezes. What followed was one of the most emotional trading environments in recent history—marked by memes, misinformation, and millions of dollars lost by latecomers.

What many forget is that trading hype without a defined exit strategy is gambling. The traders who lost the most were those who entered late, had no risk controls, and held on in blind hope.

“Crowd-sourced trades often lack exit planning. That’s the fatal flaw.”

– Kevin O’Leary, Shark Tank Investor

While the GME frenzy was unprecedented in scale, the mistake behind it wasn’t new—it was emotional trading. If you want to capitalize on momentum with better odds, explore our expert-driven day trading alerts to enter with logic, not hype:contentReference[oaicite:0]{index=0}.

✅ Pros and ❌ Cons of Emotional Trading

- ✔ Excitement and fast-moving opportunities

- ✘ No rational entry or exit point

- ✘ Susceptible to herd behavior and manipulation

📦 Key Takeaway

Hype fades. Strategy scales. Real traders don’t chase—they prepare, plan, and protect their downside.

“Your emotions will betray you more than any chart ever will.”

– Unknown

For a deeper behavioral analysis of trading crowds, refer to the Harvard Business Review’s article on irrational traders.

🪙 Luna & FTX: Blind Trust in Hype

💡 Summary:

Terra Luna collapsed from over $80 to less than a penny in just a few days. Investors believed its algorithmic stablecoin was “mathematically secure.” Then came FTX—a crypto exchange backed by celebrities and praised by major media—whose implosion exposed billions in fraudulent accounting and wiped out life savings overnight.

In both cases, blind faith replaced due diligence. Many skipped the basics: reviewing company structures, auditing financials, or even reading whitepapers. Instead, they trusted influencers, hype videos, and speculative community promises.

“If it’s ‘too good to be true,’ assume it is.”

– Molly White, Crypto Critic

For a more grounded look at crypto’s future, review our latest Bitcoin price prediction breakdown and avoid being the next exit liquidity:contentReference[oaicite:0]{index=0}.

✅ Pros and ❌ Cons of Hype-Fueled Crypto Investing

- ✔ Early adopters can benefit in true innovations

- ✘ Lack of regulation = high fraud risk

- ✘ Community buzz ≠ financial integrity

📦 Key Takeaway

Trust is earned, not airdropped. Verify everything—especially in emerging markets. Do your own research (DYOR) isn’t just advice—it’s survival.

“Trust is earned, not airdropped.”

– Anonymous Crypto Developer

If you’re wondering how to navigate future risks and rewards in the digital asset space, check our Litecoin forecast and future mining analysis.

🔗 Trusted External Resources

Explore these expert-backed resources to dig deeper into the psychology, history, and technical frameworks behind each historic trading decision.

📉 SEC Crash Report

A breakdown of the 1929 crash and margin rules post-1934 by the U.S. Securities and Exchange Commission.

Read the Report →🧠 MIT on Behavioral Finance

MIT Sloan’s interactive case study on how market psychology creates bubbles and overreaction.

View Case Study →💬 Warren Buffett on COVID Panic

Legendary insights on market fear and investor reactions during the 2020 pandemic sell-off.

Watch Interview →📊 Harvard on Irrational Trading

Harvard Business Review article on the emotional traps investors fall into—and how to avoid them.

Read Article →