Best Swing Trading Strategies for Beginners

🌀 What Is Swing Trading?

“The goal of a successful trader is to make the best trades. Money is secondary.”

— Alexander Elder, professional trader & author of Trading for a Living

Swing trading is a short- to medium-term trading strategy where traders aim to capture price moves—or “swings”—that typically last from a few days to a few weeks.

Unlike day trading, where positions are opened and closed within the same day, swing traders hold positions overnight and may ride trends for multiple sessions. This allows more time flexibility and lower stress, especially for traders who have jobs or prefer not to stare at charts all day.

Swing trading is all about timing market momentum.

Using technical indicators like moving averages, RSI, and candlestick patterns, swing traders look to enter trades just after trends begin—and exit before they lose steam.

Expert Insight:

“Swing trading gives you the space to think and the ability to adapt. You’re not forced into snap decisions every second of the day.”

— Linda Raschke, veteran trader featured in Market Wizards

🔍 How Does It Work?

Swing traders often scan for patterns like breakouts, reversals, or pullbacks. Once identified, they place entry and exit orders using technical signals and sometimes fundamental catalysts like earnings reports or macroeconomic news.

Example: A trader might notice that Apple stock is bouncing off its 50-day moving average. They enter the trade, set a stop-loss below the bounce, and aim to exit near resistance for a solid risk-reward ratio.

Want to improve your strategy? Here’s a full technical analysis breakdown to help you spot high-probability setups.

🎯 Why It’s Popular

- Less time-consuming than day trading

- More responsive than long-term investing

- Takes advantage of momentum, volatility, and patterns

- Ideal for part-time traders or those building skills

Swing trading strikes a balance between opportunity and manageability—it doesn’t require babysitting charts all day, but it’s still dynamic enough to stay exciting.

For those just starting out, check out our Beginner’s Guide to Stock Trading, which pairs perfectly with a swing trading approach.

🔗 Trusted Sources to Learn More:

- Investopedia: Swing Trading Explained

- IG: What Is Swing Trading and How It Works

- Benzinga: How to Swing Trade

- TradingView: Swing Trading Ideas

- Yahoo Finance: Trading Strategy Insights

Want better entries and less stress? Many traders now rely on swing trade alerts to reduce guesswork and time spent searching for setups.

🔥 Why Swing Trading Is Popular

“Swing trading allows traders to be active in the market without being chained to a screen all day.”

— Brian Shannon, CMT and author of Technical Analysis Using Multiple Timeframes

Swing trading has rapidly gained popularity among modern traders—and for good reason. It offers the perfect balance between speed and patience, enabling traders to profit from market momentum without the stress of intraday chaos.

Unlike scalping or day trading, swing traders don’t need to be glued to their monitors all day. You can manage trades in the mornings, during lunch breaks, or evenings with proper planning and alerts.

✔ Time-efficient: You can trade around your job, family, or studies. In fact, many part-time traders use swing trade alerts to stay informed without overcommitting time.

✔ Opportunity-rich: Because trades last days or weeks, you have time to analyze the setup, review news catalysts, and place strategic orders. This improves decision-making quality and lowers emotional mistakes.

✔ Flexible across markets: Swing trading works on stocks, forex, futures, and cryptocurrencies. It’s adaptable to various instruments and trading styles.

✔ Lower stress levels: Compared to day trading, swing trading has less pressure and lower screen-time demands. This gives you the ability to trade with more clarity and objectivity.

It also allows you to focus on developing your own edge through technical analysis, news timing, and event tracking—without reacting to every market tick.

Great for Beginners

New traders often find swing trading to be a manageable entry point into the market. It provides enough time to learn, strategize, and improve. If you’re new, check out our Beginner’s Guide to Stock Trading to understand the basics.

🔗 Learn More from Experts:

🧠 Core Concepts of Swing Trading

“You don’t need to trade every day. You just need to trade when the odds are clearly in your favor.”

— Mark Minervini, U.S. Investing Champion & author of Trade Like a Stock Market Wizard

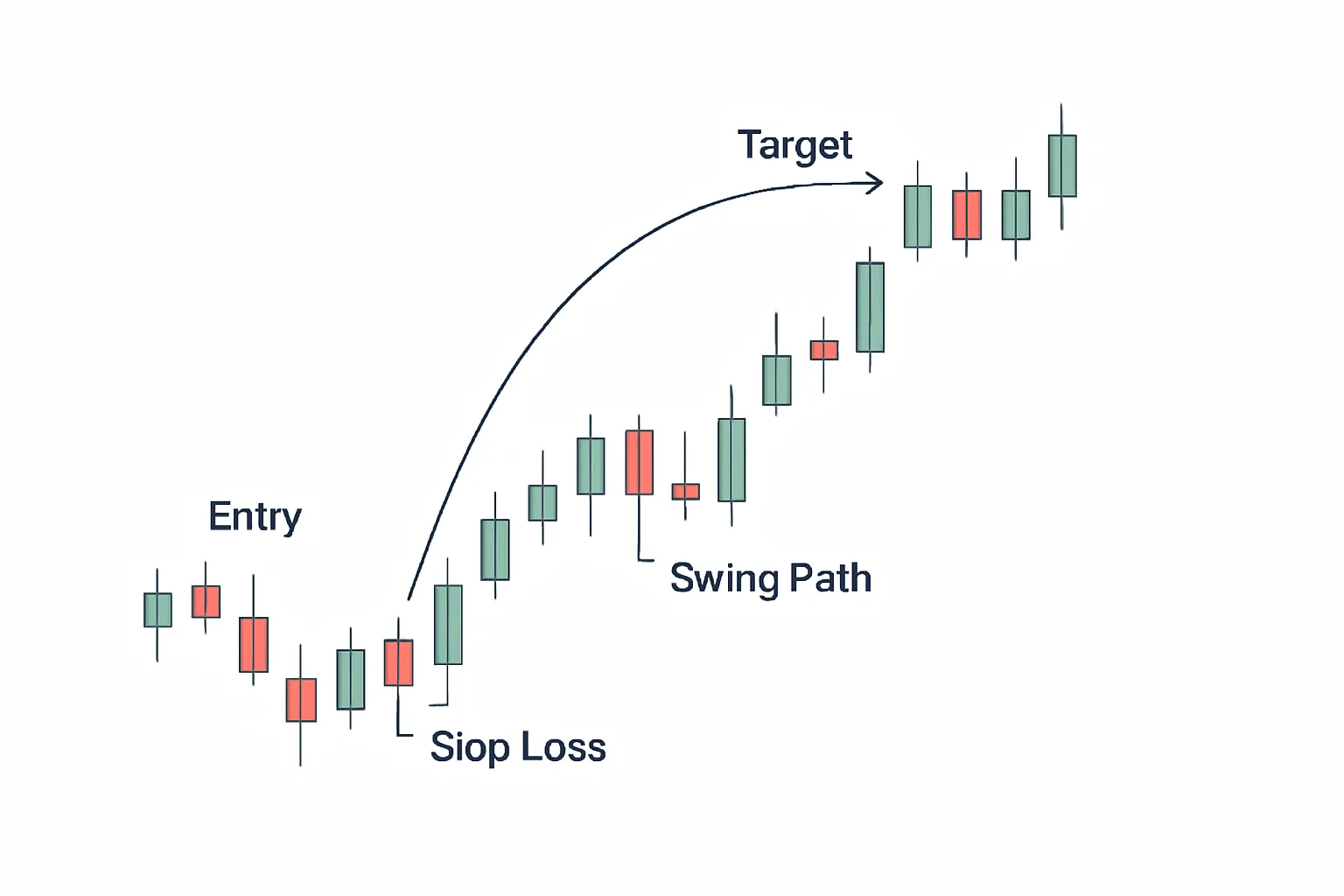

Swing trading thrives on capturing short- to medium-term price moves, often lasting from 2 days to 3 weeks. The key is to identify setups with strong directional momentum and clear risk parameters.

🔑 The Core Elements

- Trend Analysis: Determining if the market or asset is trending upward, downward, or sideways

- Entry & Exit Timing: Using tools like technical indicators to time entries at support or breakouts

- Risk Management: Setting stop-loss and take-profit levels to protect capital

- Volatility & Liquidity: Choosing assets that move enough to profit, but with enough volume to enter/exit smoothly

📘 Real-World Stories: Learning by Example

Story 1: Sarah’s Momentum Trade on Tesla

Sarah, a part-time trader from Texas, noticed Tesla (TSLA) consolidating in a tight range after strong earnings. Using RSI and a 20-day moving average crossover, she entered at $215 and sold at $238 three days later. Her trade lasted just under a week and returned **10.6%**.

She followed her plan, used a trailing stop, and avoided getting greedy. “My biggest win wasn’t the percentage gain—it was trusting my setup,” she said.

Story 2: John’s Discipline on a Losing Trade

John attempted a swing trade on AMD based on a pullback to the 50-day moving average. However, the stock broke below support. Thanks to a preset stop-loss, he exited quickly with just a 3.2% loss. “It felt like a win,” he explained, “because I stuck to my risk management rules.”

Story 3: Mia Rides a Breakout in Gold

Mia, an intermediate trader in London, spotted a wedge breakout in gold futures (XAU/USD). With volume confirmation and a bullish RSI divergence, she entered long and exited five days later at a 6.5% profit. Her analysis came from combining pattern recognition with fundamentals: central bank news boosted her confidence.

📏 Tools That Define Swing Trades

- Moving Averages (SMA, EMA): Track average prices and trend direction

- MACD: Measures momentum and potential crossovers

- Relative Strength Index (RSI): Identifies overbought or oversold conditions

- Bollinger Bands: Helps spot breakouts and pullbacks

- Chart Patterns: Like flags, wedges, and double tops

You can explore the best setups for these tools in our guide to swing trading indicators.

🌍 Expert Resources to Dive Deeper

The strongest pattern in our best swing trading strategies is trading on tests of previous highs or lows.

For example, this chart showing “Double Stop Point”

This trade entry point is a great place to enter a trad with the least amount of risk of loss. The stock can either move slightly higher or lower, but support can’t be established until there is a test in having that second stop. That why it is called a double stop point. This pattern is one of our best swing trading strategies to follow in giving you the best chances of an uptrend in the market.

In looking at the “Double Stop Point,” This stock broke out displayed in the horizontal line from a double bottom which are circled in blue. A good point of entry is to buy this stock on the first pullback which is the arrow.

The second kind of trade is called, “Single Stop Point.”

This is “purchasing a higher low” in a sequence of higher lows and higher highs (or selling a lower high at a series of lower lows and lower highs). In cases like this, there’ll only be a single stop point, but because the transaction is entered at the direction of the prevailing trend, no evaluation ought to be required.

In looking at the “single stop point” image, look at how the pattern has three numbers of a low (1), lower low (2), then a higher low (3) This is one of the many classic swing trading strategies. A good entry point to buy is (3) which is the third candlestick.

The final and third swing trading pattern is “Climax Stop Point.”

The best climax trades will happen in a high volatility environment, and following the trend has already reversed. You have to see the”climax stop point” already set up before you put in your position. If your entry is correct, the market should proceed favorably almost instantly.

Swing trading is learning how to read this charts and putting them into practice. If you are not comfortable using “real money” you can always do paper trades. Practicing these three best swing trading strategies, will help make maximum profits by putting these swing trading techniques into play.

As you can see in the two charts above, the stock TZOO has reach the following red flags for a climax top point created.

- Ten of the last 13 days have been up days

- A 68% gain over the previous 13 trading days plus a 100% move within the last month. Stock is up 900%+ since March 2009

- The biggest daily and weekly volume of the entire run

- A brand new high intraday using a close that resulted in a reduction (Day of composing: New high with a change to shut 3.69% on quantity 485 percent larger than average)

- TZOO is trading more than 130% over its 200-day moving average

⚖️ Swing Trading vs. Other Strategies

“Different trading styles suit different personalities. Know yourself before choosing a strategy.”

— Rayner Teo, former prop trader & founder of TradingwithRayner

Swing trading isn’t the only path to trading success, but it offers unique advantages compared to other popular styles. Below is a breakdown of how swing trading stacks up against day trading, position trading, and scalping.

📊 Strategy Comparison Table

| Strategy | Holding Period | Screen Time | Trade Frequency | Best For |

|---|---|---|---|---|

| Swing Trading | 2–14 Days | Moderate | Few per week | Part-time traders |

| Day Trading | Minutes to Hours | High | Many per day | Full-time traders |

| Position Trading | Weeks to Months | Low | Few per month | Long-term investors |

| Scalping | Seconds to Minutes | Very High | Dozens per day | Speed-focused traders |

✅ Pros of Swing Trading

- ✔ More time to analyze trades — no rush to react in seconds

- ✔ Ideal for part-time traders balancing a job or family

- ✔ Lower fees compared to high-frequency trading due to fewer trades

- ✔ Profit potential from both trending and ranging markets

- ✔ Psychologically manageable — no constant decision-making under pressure

❌ Cons of Swing Trading

- ❌ Overnight risk — trades exposed to gaps and market-moving news

- ❌ Requires patience — not every day will present a setup

- ❌ Trend reversals can wipe gains if not managed well

- ❌ False breakouts may lead to stop-outs if confirmation isn’t used

Some traders are naturally drawn to fast-paced action. If that’s you, day trading or scalping might be your calling. But if you prefer strategic planning and less pressure, swing trading offers a powerful alternative.

To find out which strategy suits your personality, read our in-depth comparison: Beginner’s Guide to Stock Trading.

Mastering any strategy requires discipline and patience. Read more about how to avoid overtrading and stay consistent over time.

Want to skip chart scanning? Try our swing trade alerts that deliver proven setups to your inbox.

🔗 Strategy Resources from Trusted Sites:

📈 Best Swing Trading Strategies

“Amateurs go broke by taking large losses. Professionals go broke by taking small profits.”

— William J. O’Neil, founder of Investor’s Business Daily

Swing traders use a variety of strategies depending on market conditions, asset class, and personal style. Below are some of the most effective—and time-tested—approaches that help traders capture consistent moves without overtrading.

1. 📊 Trend Following Strategy

Trade in the direction of a clear trend. Wait for pullbacks or continuation patterns before entering.

- Use: Moving Averages, MACD crossovers, trendlines

- Entry Tip: Enter after confirmation of a higher low in uptrends or lower high in downtrends

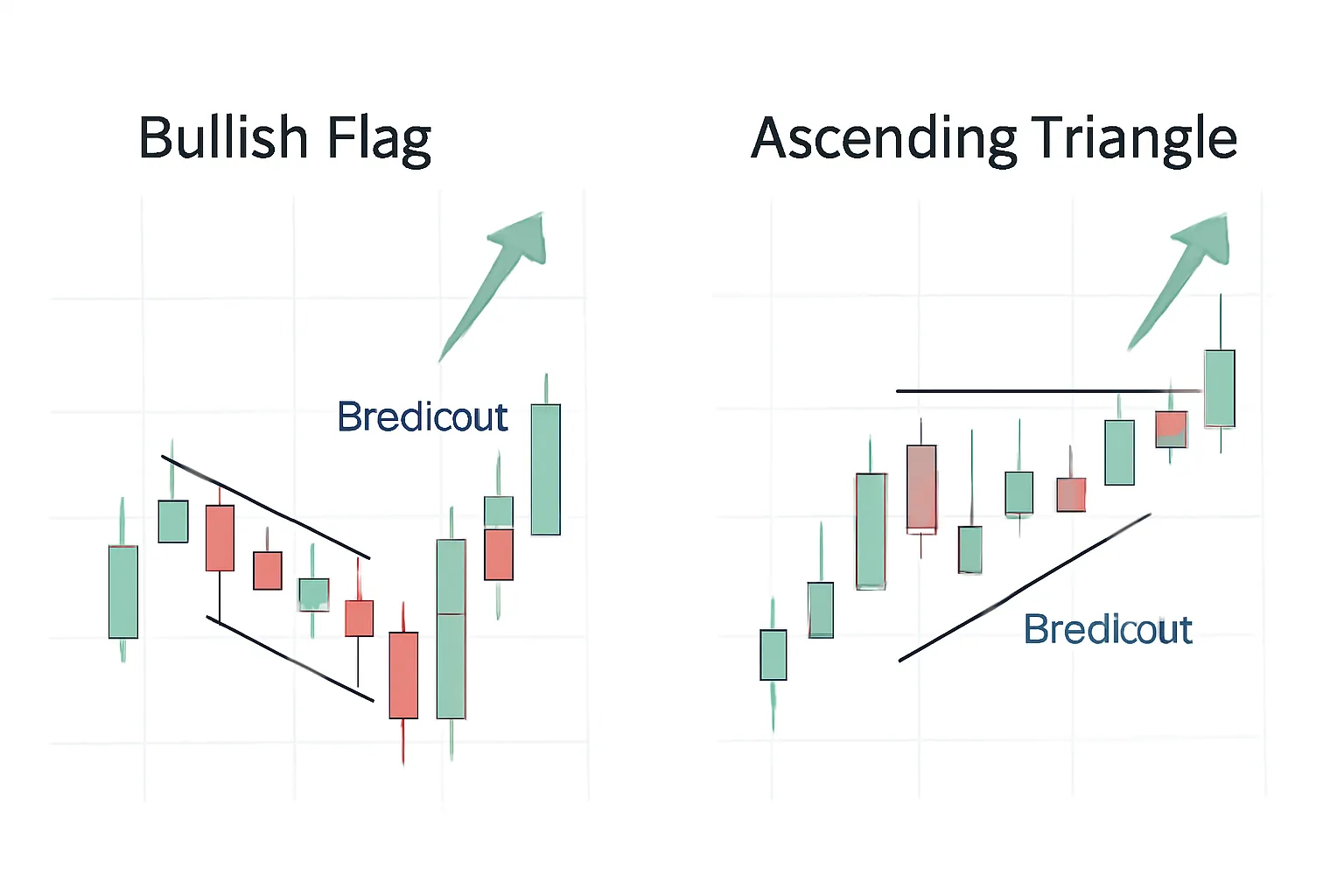

2. 🚀 Breakout Strategy

Identify key levels of resistance or support. Enter when price breaks with volume confirmation.

- Ideal for: High volatility markets or post-news events

- Watch: Candle closes above resistance + rising volume

3. 🔁 Pullback Strategy

Wait for a dip in an existing trend. Look for retracements to key moving averages or Fibonacci levels.

- Use with: Trendlines, EMA support zones, bullish engulfing candles

- Confirm with: RSI pulling out of oversold/overbought zones

4. 🔄 Reversal Strategy

Trade against the current trend at signs of exhaustion. Look for divergence between price and indicators.

- Riskier, but rewarding: Tight stop-losses are key

- Best used with: RSI divergence, double top/bottom, volume drops

5. ⏳ Range-Bound Strategy

Trade within a sideways price channel. Buy near support, sell near resistance, repeat.

- Useful when: Market lacks a clear direction

- Pair with: Bollinger Bands or Stochastic Oscillator

🧠 NEW: Multi-Timeframe Confirmation

One of the most overlooked edge-enhancers: Using multiple timeframes for confirmation.

For example, confirm a breakout on the daily chart with bullish momentum on the 4-hour chart. This alignment improves trade reliability and filters out noise.

📶 NEW: Volume-Based Strategy Filters

Volume helps validate price moves. For any strategy you use, ensure that breakouts or trend continuations are backed by increasing volume.

- Low volume = caution; breakout may be fake

- High volume = strong interest, more conviction

📝 Trade Journaling = Strategy Booster

Want to improve every strategy over time? Start a swing trading journal. Log your setup, reasoning, entry/exit, and outcome. Patterns will emerge over time.

We break this process down in our technical analysis guide, which shows how journaling ties into performance review.

And when you’re ready to streamline your execution, consider using our smart alert system—designed to highlight high-quality swing setups with minimal chart time.

❓ FAQs About Swing Trading

Swing trading can feel overwhelming at first, but once you understand the mechanics, it becomes a strategic and manageable way to trade. Here are some of the most common questions new and experienced traders ask:

What is the ideal holding time for a swing trade?

Most swing trades last between 2 days to 3 weeks, depending on the trend’s strength and the market’s volatility. The key is to ride a momentum move, not overstay it.

Do I need to watch the markets all day?

No. That’s one of swing trading’s biggest benefits. With a proper strategy and alert system, you can manage trades by checking in once or twice per day. Our swing trade alerts help many traders stay informed without screen fatigue.

How do I choose the right stock for swing trading?

Look for stocks with high relative volume, clear chart patterns, and recent momentum. Avoid thinly traded or choppy stocks. Use technical indicators like RSI or MACD and check price structure. You can learn more about this in our technical analysis guide.

Can I use swing trading on forex or crypto?

Absolutely. Swing trading works well on forex, crypto, and even commodities. Just make sure you’re aware of volatility, overnight fees (in forex), and weekend risks (in crypto).

What’s the minimum capital required to start?

While some brokers allow you to trade with just a few hundred dollars, starting with at least $1,000–$5,000 is ideal to manage risk effectively. With proper position sizing and a stop-loss strategy, you can protect your account from unnecessary drawdowns.

How many trades should I take per week?

Quality beats quantity. Most swing traders average 2–5 trades per week, depending on market conditions. Waiting for high-probability setups is better than forcing trades.

Do I need expensive tools or software?

No. Many traders succeed with free or affordable charting tools. Focus on a platform that provides clean charts, technical indicators, and watchlist features. Alerts and journaling are a plus.

Is swing trading profitable?

Yes—but only with discipline, risk management, and a repeatable strategy. Many new traders fail because they jump between systems or overtrade. The good news? With time and consistency, swing trading can absolutely grow your account steadily.

🚀 Evgeny’s $25,600 Swing Trading Success Story

Swing trading has helped countless traders achieve consistent profits—and Evgeny is one such standout. Through disciplined execution and smart risk control, he earned over $25,600 using simple strategies in a funded account.

📉 From Random Trades to Repeatable Success

Evgeny began like most traders: experimenting emotionally, lacking structure, and making impulse decisions. He admitted:

“I didn’t have a plan. I was trading randomly.”

After several painful losses, he hit pause and rebuilt his approach around patience, process, and psychology.

🧠 Strategy and Mindset

- Major forex pairs like EUR/USD and GBP/USD

- 4-hour and daily timeframes

- Breakout entries with trend confirmation

- Risking no more than 1% per trade

He also began journaling his trades and emotions—a powerful move that separated him from reactive traders. As he puts it:

“Most of my worst trades came from boredom or FOMO—not logic.”

💰 How Funded Accounts Amplified His Edge

What truly elevated Evgeny’s performance was joining a funded account program through The Funded Trader. Instead of risking his own savings, he focused on performance and process. His mindset shifted:

“Trade like it’s your job, not your lottery ticket.”

📊 Results and Takeaways

- Consistent strategy over random signals

- Process-driven journaling

- Funded structure that supports growth

- Daily risk control

“Consistency beats brilliance every time.”

📈 John Jost’s Journey from Chiropractor to Prop Firm Swing Trader

John Jost didn’t start out as a trader. He was a full-time chiropractor with an interest in the markets—but no formal financial background. Through dedication, discipline, and the prop firm structure of The5ers, John transitioned into a funded swing trader with consistent results and a brand-new career path.

📉 Learning to Trade Swing, Not Chase

- Daily and 4-hour timeframes

- Defined levels of support and resistance

- Trades with at least a 2:1 reward-to-risk ratio

- Confirmation candle entries

“One of the most important lessons I learned was patience. Sometimes no trade is the best trade.”

📊 Funded Trading Structure

“I approached trading like training—review, execution, recovery, and journaling. It became a routine, not a gamble.”

He treated every evaluation like a performance review. With each win, he scaled into larger account tiers.

🧠 Psychology First

“I stopped comparing myself to others and just focused on improving 1% every week.”

📌 Key Lessons from John’s Story

- Use time-tested levels

- Stick to predefined stop-losses

- Journal wins and losses—especially the emotional ones

- Trade checklists reduce overthinking

“Funded trading isn’t a shortcut. It’s a framework that rewards the right habits.”

🏁 Conclusion: Is Swing Trading Right for You?

Swing trading isn’t just a strategy—it’s a skill set. With proper planning, risk control, and consistent review, swing trading can help you grow a trading account over time without being chained to a screen all day.

If you’re someone who wants to trade around a day job, enjoys technical analysis, and prefers quality over quantity—then swing trading might be the sweet spot you’ve been looking for.

But remember, even the best strategy fails without discipline. Learn, adapt, and track your results. Focus on risk-reward consistency, not constant action.

Start with paper trading, study historical patterns, and use a tool like our smart alert system to identify the cleanest opportunities in any market condition.

Final tip: Every professional swing trader was once a beginner. Your edge develops through repetition, journaling, and refinement.

🔗 Trusted Resources to Deepen Your Swing Trading Knowledge

Investopedia

Learn what swing trading is, how it works, and what strategies traders use to manage their positions over time.

IG Academy

A complete beginner’s guide to swing trading, including timeframes, examples, and strategy templates.

Benzinga

Explore actionable swing trading tips, platform reviews, and top indicators for different markets.

TradingView Ideas

Live swing trading charts and trade ideas from real traders around the world. Great for pattern spotting and volume setups.

DailyFX

Understand the core techniques behind swing trading, from psychology to indicator-based entries.

📚 Explore More from TradeStockAlerts

If you’re just getting started, be sure to check out our detailed guide on what shorting means in day trading—a must-know for managing downside risk.

Looking for real-time setups? Our swing trade alerts service is tailored for traders who prefer high-probability setups over noise.

Need inspiration? Don’t miss how one trader turned $1,000 into $10,000 using smart risk control and our alerts.

Considering long-term investments too? We’ve broken down stocks vs. gold and revealed the best stocks to buy now for growth in 2025 and beyond.

👉 Stay disciplined, stay informed—your trading edge starts with the right tools and education.