What YOU need to know about Tesla…

The automotive and clean energy company TESLA has been growing a lot in the past years. This is due to its unique and remarkable designs of vehicles that are continuously having a positive appeal to customers and appear to cause a massive impact on the whole auto industry itself.

Tesla car units operate on electricity. They are integrated with a built-in rechargeable battery that can be powered up even at home or at designated charging stations. Despite the vehicles being more expensive than typical cars, the main benefits of owning one include being environmentally friendly as it emits zero air pollutants. It also boasts super advanced features like the use of artificial intelligence for navigation and the famous auto-pilot system.

As the sales of Tesla vehicles continue to increase over time, so does the value of the company in terms of stocks.

As the sales of Tesla vehicles continue to increase over time, so does the value of the company in terms of stocks.

Currently, Tesla is worth $649.5 Billion, ranking 7th on the list of the highest-valued companies in the world. For the past ten years, the average annual return of the company is recorded to be at 56.7%.

The important question is, based on their past and current performance, would their success continue to go all the way up in the coming years or would it plummet eventually?

A Quick Background on the Company

In 2003, TESLA was established by its two original founders, Marc Tarpenning and Martin Eberhard. These marvelous engineers aspired to revolutionize the industry of powered vehicles by creating cars and mobiles that are solely dependent on electricity instead of fuel.

Even though the common belief that Elon Musk founded the company turned out to be false, he still did play a crucial part in pioneering the investors that enabled Tesla to grow and be placed into where it is now.

From its first vehicle released in 2008 up to the present, the company managed to produce more than a million units. Thus, sealing their position as the top competitor in the EV market today.

Having the knowledge of the company’s history will prove beneficial in formulating a probable prediction of Tesla’s stock condition in the following years to come.

What Might Happen in the Next 5 To 10 Years?

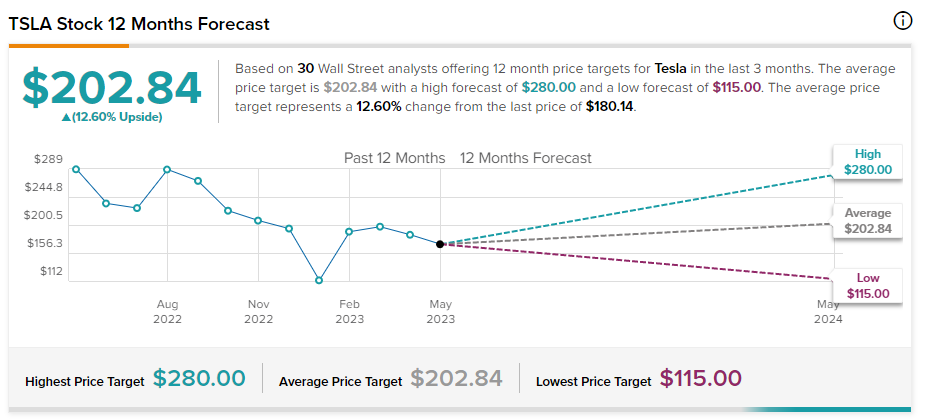

As of the month of May 2023, the value of Tesla stock is at $167.98 based on NASDAQ. The estimated price target for TSLA in the next 10 months is $218.95 per share; a 7.98% increase if that target is accomplished. Tesla Stock Predictions for 2025 should be around $250 to $300 per share. The lowest forecast rests between $33.33 to $35.36 while the highest can stand up to even $430.33. As for the prediction in five years of time, Wallet Investor sees up to $564.24 per share.

How about TSLA forecast further into the future?

If Tesla would be consistent with their annual return up until 2040, CoinCodex estimates that each stock would be priced at $671, 757. Meanwhile, some sources project that it can range from $13, 680 to $15, 660. However, with all the unforeseen circumstances and ever-changing variables, that prediction seems too huge to even accomplish. A more plausible forecast would be to compare it to the average annual return of the S&P 500 index which is 11.8%, recorded between 1957 and 2021. If this rate is to be followed for Tesla, we can expect it to be priced at $1, 541 a share by 2040.

Factors that may Affect the Forecast and Variables to Account for

There are a lot of factors that affect the value of stocks as time goes by. Needlessly saying, the same goes for TSLA stocks. One of the things we need to consider in drafting a forecast is the state of demand for electro-powered vehicles all around the globe. During the first nine months of the year 2022, Tesla units amounted to 65% of all sales of electric vehicles in the United States. Apart from the US, Tesla is also starting to venture out into Europe and even China as well. With this, the competition is only about to become fiercer. Other variables include interest rates that could lead to a lower equity value. On the other hand, a higher rate will tend to decrease the demand since the cost of loaning will also go up. By analyzing such factors, investors will have more insight into how much more Tesla can increase their sales, and widen their cash flow and profit in the far future.

Tesla’s Ground Breaking of New Lithium Refinery

Another major stepping stone that could support the positive performance of the company is the construction of its own lithium refinery in Corpus Christi, Texas. The groundbreaking ceremony happened last 8th of May, piloted by the top executive, Elon Musk. This event is a big deal for the company since not only is it the first of its kind in entire North America, but it would also probably pave the way to constructing more similar domestic facilities later on.

The project is designed to expand up to three square kilometers once finished and is estimated to cost $375 Million. Upon looking at the benefits the company can acquire from it, it might just be more than worth it. Tesla aims to make this facility as safe and as efficient as possible for processing the minerals and chemicals needed to make lithium batteries. The cost of materials is also expected to be 60% cheaper compared to the initial refining solutions and should consume 20% less energy. This way, Tesla can ensure the safety of their workers, and the towns nearby, all while reducing the overall expense of production per unit. It is a truly revolutionary step indeed that could further elevate the value of the company as time goes by.

To sum up everything, TSLA stocks is set for a fruitful condition in the long-term run. It is believed that their market value will only continue to grow and expand as they continue to innovate their products and as the demand for them increases. It is also highly reassuring that Tesla shows strong eagerness to remain at the top by optimizing their production process and continually applying their motto of clean efficiency. With all of those things considered, you will be able to create a rational and safe approach to stocks and trading. Nonetheless, not everything will go the way we want it to all the time. Hence, it is still imperative to be extra careful in picking which company to look after and which shares to buy. Conduct thorough research if needed before making a decision that involves a hefty amount of money. Remember to always account for all variables and only take calculated risks.

As we stand at the crossroads of technological innovation and sustainable energy, Tesla (TSLA) remains a focal point for investors looking to the future. While predicting stock prices a decade ahead is a formidable task, we can explore some factors that may influence TSLA stock in 2030, 2040, & 2050.

Electric Vehicle Market Growth:

Tesla’s dominance in the electric vehicle (EV) market has been a key driver of its stock performance. Predictions for 2030 hinge on the continued growth of the EV market, with governments worldwide pushing for cleaner alternatives. If Tesla maintains its position and adapts to changing market dynamics, it could benefit from an expanding customer base.

Innovation and Technology:

Tesla’s success is intertwined with its ability to innovate. The company’s advancements in autonomous driving, battery technology, and energy solutions could play a pivotal role in shaping its future. Investors will likely keep a close eye on Tesla’s technological developments and how they translate into market competitiveness.

Global Expansion:

Tesla’s international presence is a key factor in its growth strategy. Expanding into emerging markets and solidifying its position in established ones could be crucial for the company’s stock performance. Regulatory challenges, cultural differences, and competition will all influence Tesla’s success on a global scale.

Energy and Sustainability Focus:

Beyond electric vehicles, Tesla has ventured into renewable energy solutions. The success of its energy products, such as solar panels and energy storage, may contribute significantly to its stock performance. Investors with a focus on sustainable and eco-friendly companies may find Tesla appealing if it continues to champion environmental causes.

Market Sentiment and Speculation:

Stock prices are also influenced by market sentiment and speculative behavior. Public perception, media coverage, and even social media trends can impact investor sentiment. As Tesla continues to be a subject of public interest and debate, these intangible factors may play a role in shaping its stock trajectory.

While predicting TSLA stock prices for 2030 remains uncertain, investors can assess the company’s trajectory based on its response to industry trends, technological advancements, and global challenges. It’s crucial for potential investors to conduct thorough research, consider the risks, and remain informed about Tesla’s evolving narrative in the years leading up to 2030, 2040, & 2050. As with any investment, a diversified and well-informed approach is advisable, recognizing the dynamic nature of the stock market.