The Proven High-Frequency Trading Formula That Beats the Market

Quick Summary — The Proven High‑Frequency Trading Formula

High‑Frequency Trading (HFT) uses ultra‑low‑latency data, algorithmic decision‑making, and lightning‑fast order execution to capture tiny price discrepancies in milliseconds. This first block clarifies what HFT is, how it evolved, and where it fits relative to active styles like day and swing trading—setting the stage for the formula you’ll apply next.

Understanding High‑Frequency Trading (What It Is, Why It Matters, and How It Differs from Other Styles)

High‑Frequency Trading (HFT) is an algorithmic approach that submits and cancels orders at blazing speed to exploit micro‑inefficiencies across venues. While each trade’s edge is tiny, the massive volume and near‑instant execution can compound into meaningful returns when combined with disciplined risk controls.

In practice, HFT contrasts with human‑driven approaches like day vs. swing trading where holding times range from minutes to days. HFT compresses that timeline into milliseconds, relying on co‑located servers, direct market access, and smart order routing to stay ahead of the queue. For additional context, see this primer: What is HFT Trading—and does it make sense to try?

“Speed is nothing without accuracy; timing is nothing without discipline.” — Market adage shared in quant circles

From Milliseconds to Microseconds: A Short History

HFT blossomed alongside electronic trading and decimalization, which narrowed spreads and rewarded fast, precise market making. Over time, improvements in network latency, FPGA acceleration, and exchange co‑location pushed the industry from milliseconds to microseconds—reshaping how liquidity is discovered and priced.

- ✅ Granular edge at scale: Thousands of tiny, uncorrelated bets can aggregate into steady returns.

- ✅ Market‑making benefits: Tight quotes improve spreads and may earn rebates.

- ❌ High fixed costs: Co‑location, proprietary data feeds, and low‑latency hardware aren’t cheap.

- ❌ Operational risk: Software bugs or outlier events (e.g., “mini flash” dislocations) can snowball quickly.

Curious how HFT philosophy dovetails with practical trading education? Browse our best day trading books and swing trading techniques to build the mindset and structure that carry over into systematic strategies.

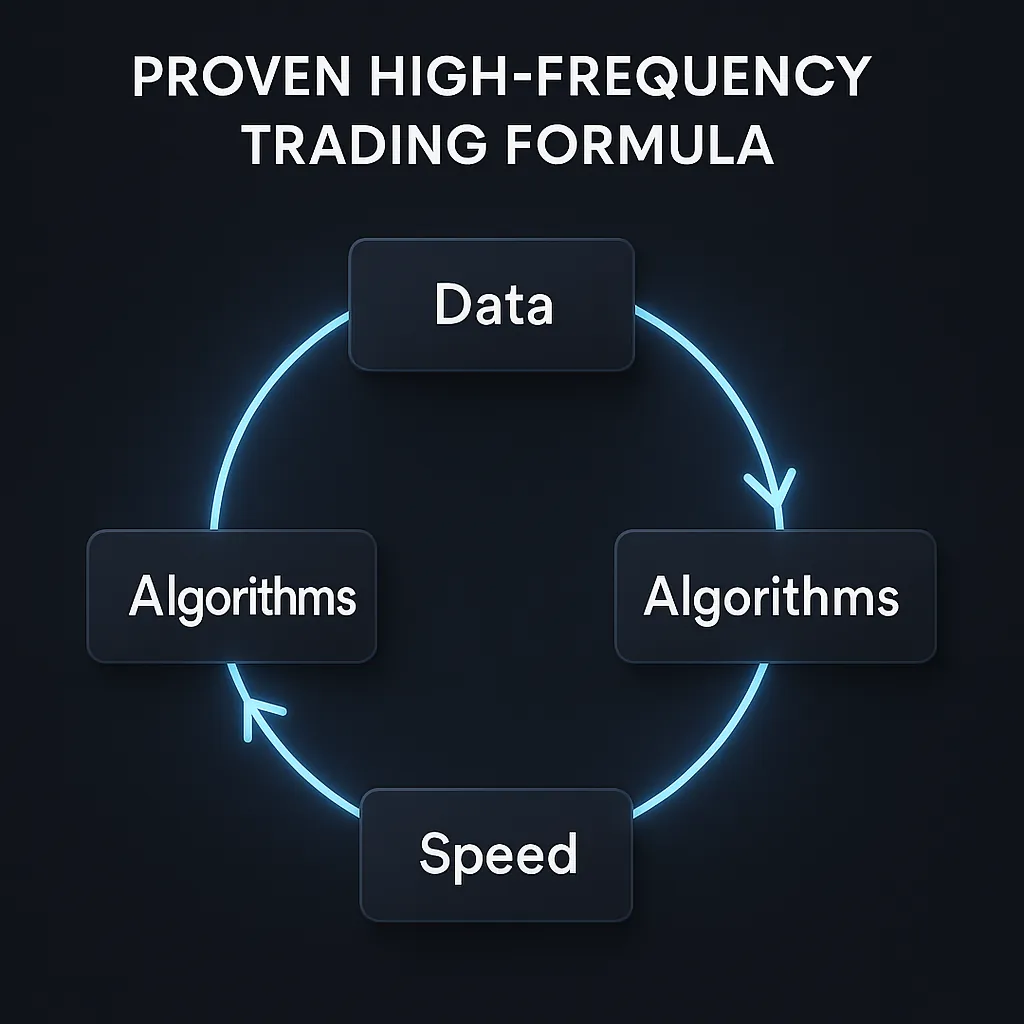

The Core Formula That Drives HFT Success (Data, Algorithms, and Speed in Perfect Sync)

Beneath the flashing lights of the trading screen lies a precise, repeatable formula that powers the most successful High-Frequency Trading (HFT) desks. This formula is a three-pillar system built on real-time data ingestion, algorithmic decision-making, and ultra-fast execution. Remove any pillar, and the structure collapses.

1. Data Ingestion

The foundation of any HFT strategy is low-latency access to market data. Traders pull feeds directly from exchanges—often via proprietary, co-located connections—to receive quotes and order book updates faster than competitors. As covered in our guide to building a diversified portfolio, quality input defines output: garbage in, garbage out.

2. Algorithmic Decision-Making

Once data is received, it flows into predictive algorithms that identify patterns invisible to the human eye. These algorithms may run statistical arbitrage models, liquidity-seeking logic, or predictive market impact estimators. As one quant famously put it:

“The model is the brain; the speed is the reflex. You need both to survive in HFT.” — Daniel Lee, Senior Quantitative Strategist

3. Ultra-Fast Execution

The final step is execution with minimal latency. Orders are routed intelligently to capture the best available prices while avoiding adverse selection. Modern HFT uses smart order routers (SORs) to split large trades, manage queue position, and instantly cancel when conditions change. Learn how rapid execution differs from human-paced setups in our day trading alerts breakdown.

- ✅ Consistency: Thousands of trades compound small gains.

- ✅ Market Neutrality: Reduced exposure to broad market swings.

- ❌ High Entry Costs: Tech, data feeds, and infrastructure are expensive.

- ❌ Regulatory Hurdles: Compliance burdens can slow adaptation.

HFT may seem distant from slower, discretionary styles, but the mindset of consistent execution applies to both. Whether milliseconds or months, the principle remains: execute the plan with precision.

Technology Infrastructure & Speed Advantage (Why Milliseconds Mean Millions)

High-Frequency Trading thrives on state-of-the-art technology. The hardware and network design that underpin your strategy are as crucial as the algorithm itself. In HFT, physical proximity to exchange servers can shave microseconds off order transmission—an eternity in this world.

1. Hardware

The core components include co-location servers housed inside exchange data centers, FPGA (Field-Programmable Gate Array) processors for ultra-fast computations, and low-latency network cards. These are purpose-built to process market data and fire off trades without unnecessary operating system delays.

2. Network Advantage

Firms invest heavily in dedicated fiber lines or even microwave transmission to cut milliseconds between data centers. The closer your hardware is to the matching engine, the higher the odds your order fills first. As we explain in swing trading techniques, timing is everything—only in HFT, the scale is exponentially smaller.

3. Software Optimization

Beyond physical infrastructure, ultra-lean code eliminates latency. HFT applications are often written in low-level languages like C++ for direct hardware control. Even a 50-microsecond delay in processing market data could mean a missed arbitrage window.

“Milliseconds can mean millions. In HFT, latency isn’t a metric—it’s a currency.” — Sarah McIntyre, Quant Developer

- ✅ Speed Leadership: First to market opportunities means higher fill rates.

- ✅ Precision: Ultra-low latency execution reduces slippage.

- ❌ Cost Barrier: Millions in annual expenses for top-tier setups.

- ❌ Obsolescence Risk: Tech upgrades are constant to stay competitive.

To see how timing translates into profitability outside of HFT, review our day vs. swing trading comparison.

Strategies That Actually Work in HFT (Proven Tactics From the Fastest Desks)

While speed is the enabler, strategy is the driver. Successful High-Frequency Trading (HFT) desks deploy a range of approaches fine-tuned for microsecond execution. These tactics aim to profit from price imbalances, provide liquidity, or trigger moves that benefit their positions—all while operating under strict risk controls.

1. Market Making

Placing simultaneous bid and ask quotes to capture the spread, often adjusted multiple times per second. This keeps markets liquid while generating steady, small profits. Learn how timing impacts entry and exit in our day trading alerts coverage.

2. Statistical Arbitrage

Algorithms detect temporary mispricings between correlated securities, executing trades to profit as prices converge. This requires sophisticated modeling and real-time recalibration.

3. Liquidity Detection

Identifying large hidden orders by analyzing partial fills and order book behavior, then trading ahead or alongside the expected market move.

4. Momentum Ignition

Attempting to trigger a series of trades in one direction to profit from the momentum—though this practice is controversial and often scrutinized by regulators.

- ✅ Market Making: Consistent returns, helps market liquidity.

- ✅ Stat Arb: Profits from predictable price relationships.

- ❌ Liquidity Detection: Potential to move against larger players if misread.

- ❌ Momentum Ignition: Regulatory risk and ethical debate.

“Strategies in HFT are like sharp blades—effective in skilled hands, dangerous otherwise.” — Javier Ortiz, HFT Risk Manager

For traders who want to blend HFT with more manual techniques, explore our swing trading success stories to see how adaptable strategies can evolve over time.

Case Studies — Winning with the Proven Formula (Real-World Examples of HFT in Action)

High-Frequency Trading success stories are rarely public, but examining real-world examples offers valuable insights. These cases reveal how the data + algorithms + speed formula works under different market conditions, and the lessons traders can apply to their own strategies.

Case Study 1 — Hedge Fund Micro-Arbitrage

A leading U.S. hedge fund used co-located servers inside NYSE data centers to identify microsecond arbitrage opportunities between ETFs and their underlying stocks. By leveraging FPGA-optimized execution engines, they captured fractions of a cent per trade across millions of trades per month. This approach mirrors the discipline outlined in our swing trading success stories, only at a vastly higher frequency and automation level.

Case Study 2 — Retail Trader Using Partial Automation

An advanced retail trader integrated semi-automated execution scripts into their forex trading. While not fully HFT, the system allowed rapid responses to arbitrage windows and news-driven moves. The trader reduced average execution time from 2 seconds to 150 milliseconds, increasing profitability by 7% over six months. Similar results can be achieved in equities by combining automation with strategies from our day trading alerts.

Case Study 3 — Market Making During Volatility

In March 2020, during extreme market volatility, a proprietary trading firm adjusted its spread-widening algorithms to capture larger bid-ask gaps without increasing inventory risk. The result was a 22% increase in daily net profits while still maintaining liquidity provision obligations.

“Case studies prove that infrastructure and discipline can outperform brute force in HFT.” — Michael Grayson, Former HFT Desk Lead

- ✅ Preparation Pays: Every winning case involved months of setup and testing.

- ✅ Adaptability: Strategies adjusted to market conditions delivered better results.

- ❌ Capital Requirement: High infrastructure costs are still a barrier for many.

- ❌ Regulatory Hurdles: Larger players must constantly navigate compliance checks.

To explore more structured learning paths that complement HFT principles, see our guide to building a diversified stock portfolio.

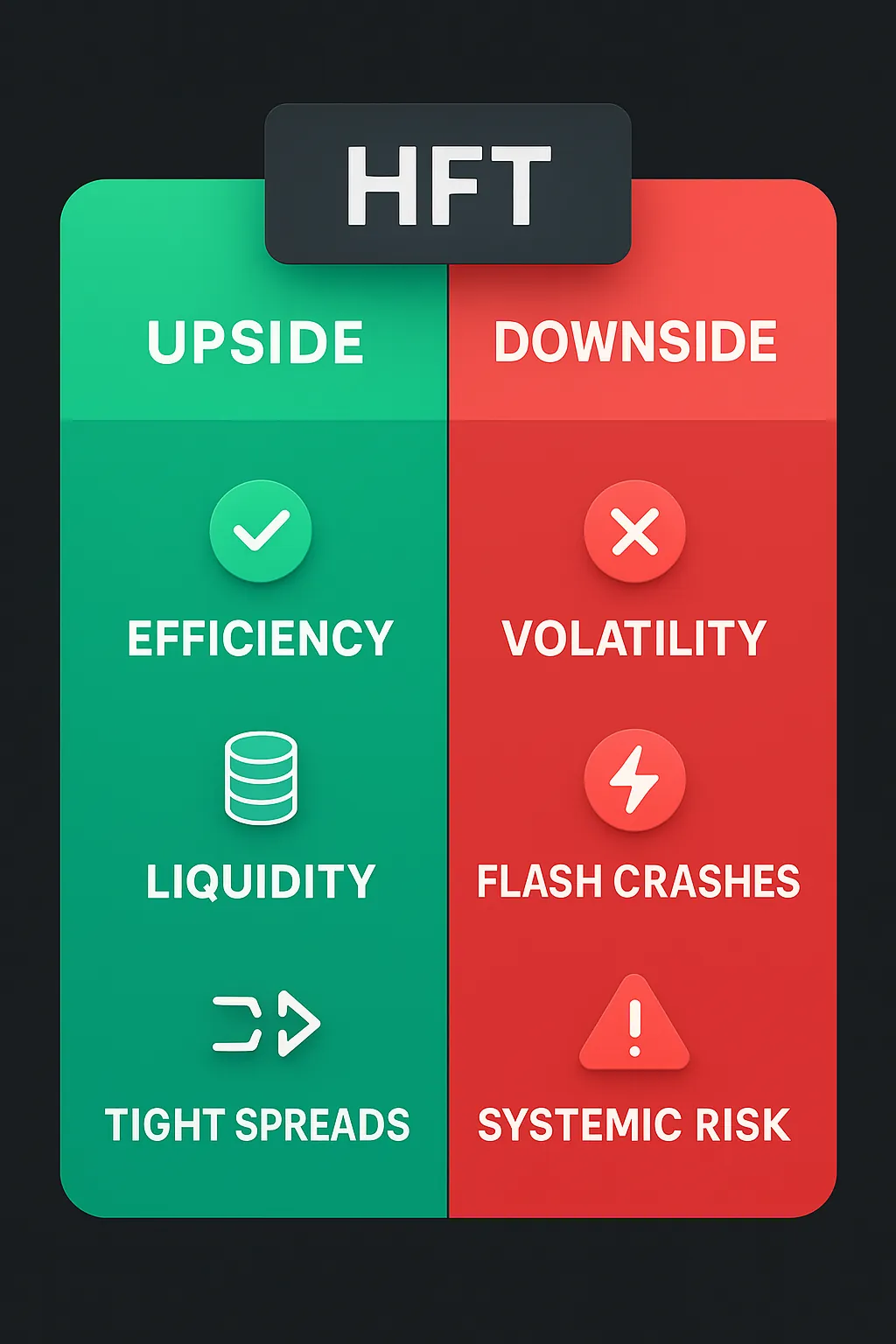

Risks, Regulations, and Market Impact (The Double-Edged Sword of HFT)

High-Frequency Trading (HFT) is often portrayed as a market efficiency enhancer—but it also carries risks that can ripple across global exchanges. From sudden price dislocations to systemic failures, understanding these dangers is essential for anyone in the HFT arena.

Technology & Infrastructure Risks

The same ultra-fast systems that make HFT profitable can also magnify losses in milliseconds. Hardware failure, network outages, or algorithmic bugs can trigger cascading losses before human intervention is possible. Kill switches and automated risk throttles are vital.

Regulatory & Compliance Challenges

Regulatory bodies like the U.S. Securities and Exchange Commission and the Commodity Futures Trading Commission scrutinize HFT activities closely. Certain strategies, such as momentum ignition or quote stuffing, can lead to heavy fines and bans.

Market Impact

HFT can improve liquidity and tighten spreads—but critics argue it can also increase short-term volatility and cause flash crashes. The 2010 “Flash Crash” saw the Dow drop nearly 1,000 points in minutes, partly attributed to high-speed trading algorithms.

“HFT is like a high-performance sports car—thrilling in the right hands, catastrophic in the wrong ones.” — Linda Barrett, Market Structure Analyst

- ✅ Pro: Adds liquidity and narrows bid-ask spreads.

- ✅ Pro: Can help reduce long-term trading costs.

- ❌ Con: Potential to trigger flash crashes.

- ❌ Con: Increases short-term volatility during stress events.

For a broader comparison between high-speed trading and traditional investment styles, see our CFD vs. stock investment guide.

FAQs + Key Takeaways (Final Insights and Action Points)

To wrap up our deep dive into the Proven High-Frequency Trading Formula, here are answers to the most common questions—along with the key lessons you can put into action right now.

Frequently Asked Questions

A: Full-scale HFT is often out of reach due to infrastructure costs, but partial automation and fast execution strategies can still give individuals a competitive edge.

A: Institutional HFT can require millions in tech investment, but lightweight algorithmic strategies can be launched with significantly less.

A: The ethics depend on the strategies used—market-making is generally seen as beneficial, while practices like momentum ignition face heavy criticism.

A: Underestimating operational and compliance risks can lead to devastating losses faster than you can respond.

“In HFT, the race is not always to the swift, but to the prepared.” — Elaine Park, Algorithmic Trading Consultant

- ✅ Pro: Potential for consistent, small-scale profits compounded over time.

- ✅ Pro: Adds liquidity and can improve market efficiency.

- ❌ Con: High entry cost and technological complexity.

- ❌ Con: Susceptible to flash crashes and systemic shocks.

Further Reading

Continue exploring advanced strategies and investor education with these resources: