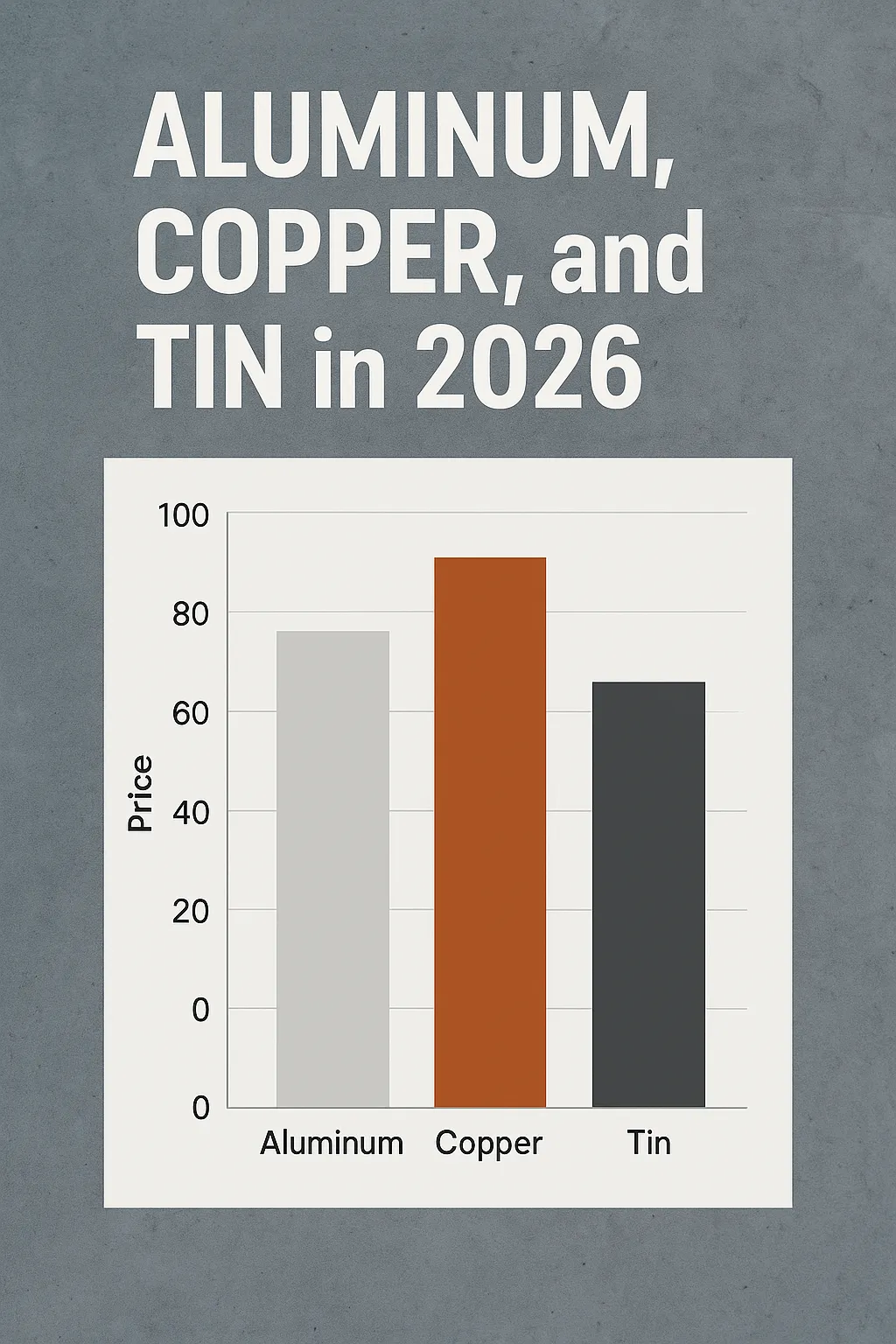

3 Surging Metals to Watch: Aluminum, Copper, and Tin in 2026

This near-future guide maps the aluminum copper tin outlook 2026—why these base metals are set to matter for portfolios, where supply and tariff pressures may tighten markets, and how demand from EVs, renewables, and infrastructure could keep prices resilient. We’ll outline the catalysts, risks, and positioning tactics for each metal so you can spot durable trends, not just headlines. If you want a concise, actionable view for 2025–2026, start here.

Quick Summary

- Aluminum: potential supply tightness vs. energy costs and tariff risks.

- Copper: structural demand from electrification + grid buildouts; watch inventories.

- Tin: sensitive to electronics cycle and supply disruptions; volatility likely.

- Strategy: prefer staged entries, watch spreads/rolls, and balance sector exposure.

Last updated: • Reading time: ~12–15 minutes

Aluminum 2026 Outlook — Supply, Energy, and Tariffs

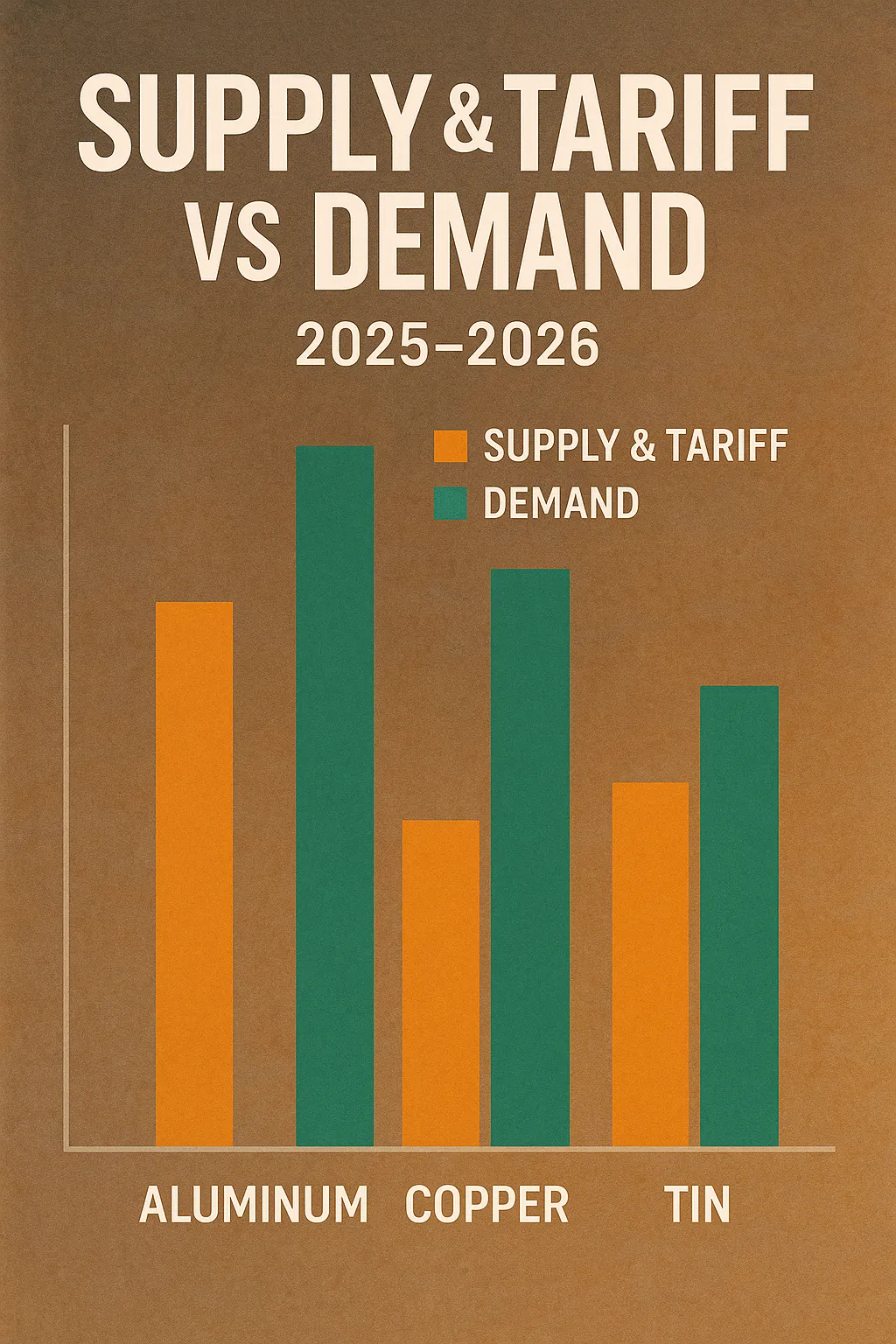

Among industrial metals, aluminum’s path to 2026 hinges on energy costs, tariffs, and supply chain bottlenecks. Energy-intensive smelting means higher oil and natural gas prices can ripple directly into production costs. Meanwhile, Financial Times reports highlight how global supply squeezes are already pushing aluminum higher, and tariffs could further tighten flows.

The aluminum copper tin outlook 2026 shows aluminum benefiting from dual forces: constrained supply and strong demand from electric vehicles, aerospace, and packaging. Yet, risks include political trade disputes and carbon-emission restrictions on smelters. Traders should watch LME inventories closely as they remain near multi-year lows.

- 📉 Potential smelter shutdowns in Europe and Asia due to high energy costs

- 📦 Supply bottlenecks from tariff disputes and trade policy shifts

- ⚡ Surging demand from EVs and clean energy infrastructure

- 🌍 Environmental rules tightening emissions standards for producers

For investors, aluminum remains central to the Critical Metals EV Boom Investing theme. A long-term portfolio allocation to aluminum-linked ETFs or futures can hedge inflation and capture industrial growth, but traders must prepare for volatility driven by tariff announcements.

Copper 2026 Outlook — Electrification & Grid Demand

Copper is often called “Dr. Copper” for its ability to diagnose global economic health. Looking at the copper market outlook 2026, demand remains structurally strong thanks to electrification, power grid expansion, and data center growth. Reuters reports that U.S. copper imports are already climbing in anticipation of tariff disputes, signaling potential supply risks.

Analysts forecast copper prices to remain elevated through mid-2026 as China’s grid expansion and Western electrification projects compete for limited supply. Still, cyclical slowdowns could lead to pullbacks, offering tactical entry points for long-term investors.

Tin 2026 Outlook — Electronics Cycle & Supply Shocks

Tin is both essential and fragile. Its role in soldering for semiconductors and electronics makes it indispensable, but global production remains concentrated in a handful of countries vulnerable to disruptions. According to Reuters analysis, tin markets in 2025–2026 face heightened volatility as tariffs and local supply constraints ripple into global pricing.

The tin price forecast 2026 is shaped by two competing forces: a potential slowdown in consumer electronics demand, and intensifying supply constraints. If either side dominates, price swings could be dramatic. Traders should monitor inventory levels on the LME alongside demand signals from semiconductor manufacturers.

- Political instability in Southeast Asian producing countries

- Tariffs and export restrictions tightening global supply

- Cyclical demand swings from the electronics sector

- Thin inventories creating sharp intraday volatility

For investors exploring diversified metals portfolios, tin can add upside potential but requires strict position sizing. Pairing tin exposure with more liquid metals like aluminum and copper can smooth risk-adjusted returns while still benefiting from base metals growth in 2026.

Macro Risks — Dollar, Rates, and China Factor

Beyond individual supply-demand stories, the industrial metals outlook depends on macro drivers like the U.S. dollar, interest rates, and China’s industrial activity. A stronger dollar can pressure commodity prices, while rate cuts typically support reflation trades. China’s policy decisions on infrastructure and EV adoption remain the wild card for 2026.

Investors should track global indices and central bank policy, but also review specialized research such as the World Bank commodity markets data. Pairing macro signals with sector-specific catalysts sharpens positioning for base metals.

Want Smarter Metals Insights?

Go beyond headlines. Get strategies that combine industrial metals with crypto, silver, and gold diversification.

Explore Silver Rally Trading SignalsPositioning Playbook — Entries, Hedging, and Time Horizons

A forward-looking base metals investment 2026 strategy means blending near-term trade setups with long-term positioning. Short-term traders can use futures spreads and ETFs for tactical plays, while longer-horizon investors might prefer diversified baskets that reduce single-metal risk.

- 📊 Stage entries around pullbacks in copper and aluminum during tariff headlines.

- 🛡️ Hedge tin exposure with broader industrial metals ETFs to offset volatility.

- ⚡ Align time horizons: trade copper tactically, hold aluminum mid-term, and use tin as a speculative sleeve.

- 📈 Rebalance quarterly using data from the World Bank and LME inventory reports.

Education is critical: review insights from diversified metals portfolio strategies alongside industry data to avoid trading in isolation. Metals don’t move in a vacuum—they respond to energy markets, policy shifts, and tech cycles.

Further Reading & Data Sources

For traders building conviction in the aluminum copper tin outlook 2026, authoritative data sources are essential. Below are high-quality resources to supplement this analysis:

📰 FT: Aluminum Supply Squeeze

Deep dive on how energy costs and tariffs are constraining aluminum output.

📈 Reuters: Copper Imports & Tariffs

How U.S. imports and tariff risks are shaping copper’s near-term future.

⚠️ Reuters: Tin Supply Shocks

Analysis of tin market disruptions from tariffs and production volatility.

🌍 World Bank: Commodity Markets

Official commodity market datasets and forecasts across industrial metals.

📊 MarketWatch: Metals Coverage

Stay updated with ongoing news, sentiment, and trading opportunities in metals.

FAQs — Aluminum, Copper, and Tin Outlook 2026

What’s the base case for the aluminum copper tin outlook 2026?

Base case: steady-to-firm prices driven by electrification, infrastructure, and supply constraints. Upside risks include tighter inventories and tariff shocks; downside risks include global growth slowdowns and a stronger USD.

How reliable is an aluminum price prediction 2026 amid tariff noise?

Tariffs add volatility, but energy costs, smelter curtailments, and LME inventories remain the core drivers. Use staged entries and reassess after major policy headlines.

What supports the copper market outlook 2026?

Structural demand from EVs, grid expansion, and data centers. Watch mine supply, treatment charges, and import trends to time entries on pullbacks.

Why is the tin price forecast 2026 so volatile?

Tin depends on electronics cycles and concentrated supply. Export restrictions, weather, and policy shifts can amplify swings when inventories are thin.

How should I approach the broader industrial metals outlook?

Pair macro signals (USD, rates, China policy) with micro data (LME stocks, smelter updates). Diversify across metals and rebalance quarterly.

What’s a sensible base metals investment 2026 allocation?

Consider a core sleeve in copper/aluminum for liquidity plus a smaller, risk-managed sleeve in tin. Hedge with broader industrial baskets; size positions to account for volatility.

Conclusion — Positioning for the 2026 Metals Cycle

Our aluminum copper tin outlook 2026 points to supportive fundamentals with policy-driven volatility. Aluminum hinges on energy and tariffs, copper on electrification and grids, and tin on electronics demand vs. concentrated supply. Use staged entries, respect inventory signals, and rebalance as macro winds shift.

Build a Smarter Metals Allocation

Blend base metals with precious and digital assets for diversification and momentum opportunities.